CurrencyFair is a cutting-edge platform that provides international money transfer services to businesses and individuals alike. With its easy-to-use online platform and robust security measures, CurrencyFair is changing the way people transfer money across borders. The platform leverages the latest technology to provide a streamlined, user-friendly experience that is both efficient and cost-effective.

CurrencyFair operates in many countries around the world, where it allows customers to take advantage of local exchange rates and avoid the high fees typically associated with international transfers.

In addition, CurrencyFair is fully licensed and regulated, providing customers with the peace of mind that comes with knowing that their funds are protected.

This article will provide a comprehensive review of CurrencyFair – we’ll cover the platform’s history, services, and impact in the industry, as well as who can benefit the most from using their services. We’ll also examine the advantages of using this provider for international transfers, the security measures in place to protect customer funds and information, and the cost-effectiveness of the platform compared to traditional banks.

Who are CurrencyFair?

CurrencyFair is a leading fintech company that was founded in 2009 with the goal of providing a better solution for international money transfers. Since its inception, the company has grown rapidly, serving customers in over 150 countries around the world.

CurrencyFair’s main service is the peer-to-peer platform that enables individuals and businesses to transfer money directly to each other, bypassing traditional intermediaries like banks. This approach not only reduces costs, but also speeds up the process and allows customers to take advantage of local exchange rates.

In addition to its core platform, CurrencyFair also offers a range of other services, including foreign currency exchange and the ability to send money directly from a debit or credit card.

CurrencyFair has made a significant impact in the international money transfer industry, and its innovative approach has been recognized by both customers and experts in the field. The company has been praised for its transparency, ease of use, and low fees, and it has quickly become one of the most trusted and widely used platforms for international money transfers.

CurrencyFair is designed to be accessible and useful for a wide range of customers, including small business owners, freelancers, expats, and individuals who need to transfer money abroad. The platform’s security measures provide peace of mind for those who are concerned about the safety of their funds.

CurrencyFair Pros & Cons

| Pros | Cons | |

|---|---|---|

| 1. | Competitive exchange rates – Customers who use CurrencyFair’s marketplace can take advantage of very low exchange rates on their currency transfers. Those who use regular bank transfers get a favorable markup on their exchange rates of 0.45% on average. | No dedicated dealers for personal users – CurrencyFair provides dedicated account managers only to business clients. |

| 2. | Great customer service – Besides the extensive knowledge base, users can always reach CurrencyFair’s customer service via phone, email, and live chat. | Limited funding options – CurrencyFair allows their customers to only use their bank accounts to send money through their platform. Debit and credit cards cannot be used to fund any domestic or international money transfer. |

| 3. | Instant custom quotes – CurrencyFair provides transfer information without requiring an online account. They can provide any visitor with a free quote stating the related fees and the time it would take to complete a certain transfer. | No cash pick-up option – Recipients can only get their money in their personal bank accounts. |

| 4. | Solid Trustpilot rating – The star rating of CurrencyFair is 4.4 out of 5 at the moment of writing (February, 2023) | Limited currency coverage – Customers are able to make money transfers in about 20 different currencies. CurrencyFair doesn’t support exotic and less-used currencies. |

| 5. | Global service coverage – At the moment, CurrencyFair is available to customers in over 150 countries all around the world. | Low mobile app rating for Android users – Currently, CurrencyFair’s mobile app for Android has a rating 2.6 out of 5 stars (February, 2023) |

| 6. | Fast money transfers – With CurrencyFair, international money transfers can take about 0-2 business days to complete, on average. | |

| 9. | Exchange rate alerts – CurrencyFair customers can set up daily, weekly, or custom exchange rate alerts and get notified by email or mobile notifications. | |

| 10. | Fixed transfer fee – CurrencyFair’s transfer fee is always fixed and low, no matter the amount of the transfer | |

| 11. | Numerous awards for excellence and outstanding performance in the finance sector | |

| 12. | Suitable for both small and large international money transfers |

CurrencyFair Key Attributes

- Founded: 2009

- Headquarters: Dublin, Ireland

- Other offices: CurrencyFair opened their first office in Dublin (Ireland), but soon, they managed to expand to Newcastle (Australia), Nutfield (the United Kingdom), Singapore, and Kwun Tong (Hong Kong);

- Annual trading volume: On a yearly level, CurrencyFair trades about $300 million in both small and large money transfers;

- Number of employees: At the moment, CurrencyFair is considered a small international business with an employee number of 156, operating at all of their international branches and offices;

- Trustpilot rating: CurrencyFair is maintaining a solid ranking on Trustpilot. Currently, they stand at 4.3 out of 5 stars (February, 2023);

- Number of clients: On average, about 150,000 private and corporate clients flock to CurrencyFair for their international money transfer and currency exchange needs on an annual level;

- Available countries: CurrencyFair is available in over 150 countries on all continents making the service one of the most available money transfer global providers;

- Number of currencies: Compared to similar companies, CurrencyFair’s currency support is a bit lower with about 20 different currencies available for exchange and transfer;

- Minimum transfer limit: While CurrencyFair imposes a minimum limit on each money transfer amount, theirs is one of the lowest among similar providers. Everyone who wishes to make an international money transfer with CurrencyFair needs to send at least $10 (€8, £7, or currency equivalent);

- Maximum transfer limit: CurrencyFair has one of the most relaxed caps on how much customers can send through them. No matter the currency, private or business users can make an international transfer of up to 10,000,000 in any supported currency;

- Transfer fee: While CurrencyFair does impose a transfer fee on each money transfer for all customers, the fee amount is always low and fixed. No matter the sending amount, customers will have to pay €3.00 (£2.50, or currency equivalent) for the entire transfer;

- Exchange rate markup: With CurrencyFair, besides the transfer fee, customers will notice an added markup to their exchange fee. This markup is added to the mid-market rate of the selected currency and is 0.45% on average. In some instances, this markup can fluctuate and range from 0.10% to 0.60%.

- Sending money through: To send money abroad using CurrencyFair, customers need to connect their personal/business bank account to their CurrencyFair online account. There are no other payment methods available;

- Receiving money through: Recipients are able to receive money with CurrencyFair only in their provided bank account. The service doesn’t offer a pick-up cash option;

- Payments flexibility: To make international money transfers, customers can use CurrencyFair’s mobile app or web platform. They can also discuss initiating a transfer through one of CurrencyFair’s phone numbers.

- Supported languages: Visitors can select English, French, and German as the language on CurrencyFair’s website;

- Regulated by: Currently, CurrencyFair is authorized by:

- Central Bank of Ireland in the European Union;

- Financial Conduct Authority (FCA) in the United Kingdom;

- Australian Securities and Investments Commission (ASIC) in Australia;

- Financial Crimes Enforcement Network (FinCEN) in the US;

- Monetary Authority Singapore (MAS) in Singapore;

- Customs and Excise Department in Hong Kong.

- Mobile app: CurrencyFair does provide a mobile app for every smartphone user. Customers can download the Currency fair on Google Play for Android users (rating of 2.6 / 5 stars) and the App Store for iOS users (rating of 4.5 / 5 stars). With this app, they can perform a number of financial activities, including:

- Secure access to CurrencyFair’s services;

- Transfer money internationally;

- Manage and exchange multiple currencies;

- Overview and compare real-time exchange rates;

- Monitor the status of money transfers they have initiated;

- Receive notifications when a transfer is completed;

- Make cross-border payments like paying bills;

- Awards: In their short existence, CurrencyFair has been recognized multiple times for their outstanding performance in the finance sector. Their awards include:

- Best of Show (Finovate Asia, Singapore, 2012);

- Most Insightful and Intriguing Internet Innovation (IIA Dot IE Net Visionary, 2013);

- TNW’s Irish Startups (2013);

- one of the Best Middleweight Start-ups (Europas, 2013);

- Excellence in Payments (FinTech Australia, 2017);

- Top 20 Fintech Companies in Ireland (Irish Tech News, 2017);

- Fintech Startups in Europe to watch in 2018 (2017);

- Mozo Experts Choice Awards (Mozo.com.au, 2018);

- Top 100 Startups to watch in 2018, Silicon Republic (2018);

- Top 10 Startup Winner for Best Employer (LinkedIn, 2018 and 2019);

- Spiders Award for Best in Fintech (2019);

- 5-Star Rating for Outstanding Value International Money Transfers (Canstar, 2019).

CurrencyFair Features

CurrencyFair is a peer-to-peer money transfer service that provides a cost-effective and convenient way to transfer money globally. The platform operates by matching users who want to exchange currencies and facilitating the transaction between them. This eliminates the need for intermediaries and significantly reduces transfer fees compared to traditional money transfer services.

Since CurrencyFair serves both personal and business users, they offer dedicated services to best meet their needs.

Features for Personal Users

- Easy to Use Platform: The platform is user-friendly and intuitive, making it easy for personal users to quickly and easily transfer money;

- FX Marketplace: The marketplace is the core feature of CurrencyFair, providing peer-to-peer matching for any user that wishes to convert one currency to another. This allows CurrencyFair to provide its users with exchange rates that are significantly more competitive than those offered by traditional money transfer services and banks;

- Multi-Currency Accounts: CurrencyFair supports a wide range of currencies, allowing personal users to hold money in multiple currencies and exchange them whenever they need to;

- Real-Time Tracking: The platform provides real-time tracking of international and domestic money transfers, allowing personal users to keep track of their money at every step of the process;

- Exchange Rate Alerts: CurrencyFair provides an opportunity to set up a preferred exchange rate for any of their supported currencies. Whenever that rate is met, CurrencyFair sends an email, notifying the subscribed customer. Live alerts are also available for each day and on a weekly basis as a summary of the previous week;

- Secure Transactions: CurrencyFair uses the latest encryption technology to ensure that all transactions are secure and protected from fraud;

- Mobile App: CurrencyFair also has a mobile app that allows personal users to access their accounts and perform all of CurrencyFair’s available features from anywhere, at any time. This includes receiving live notifications for completed transfers.

Features for Business Users

Besides every feature included on personal accounts, CurrencyFair offers additional opportunities for businesses and corporate clients. Having a business account includes the following features:

- Batch Payments – CurrencyFair allows business users to process large numbers of payments at once, streamlining their payment processes;

- Multi-User Accounts – This feature enables businesses to set up multiple user accounts, each with its own permissions and access. This is great for easier management of payments, invoices, and accounting;

- Invoicing – CurrencyFair business users can create and send invoices directly from the online platform or app, improving their billing processes;

- Virtual IBANs – Businesses can use virtual IBANs to facilitate payments to or from other countries, simplifying their international payments processes;

- Automated FX – CurrencyFair enables businesses to automate their foreign exchange process, ensuring they receive the best rates at the right time. This is a powerful feature that can save companies huge amount of funds;

- Integration with Accounting Software – Business users can integrate their CurrencyFair account with popular accounting software like Xero and QuickBooks, providing a seamless experience for companies that manage many employees or contractors from other countries;

- Dedicated Support – CurrencyFair provides business users with dedicated support from a dedicated account manager to help with any questions or concerns with anything finance-related.

CurrencyFair International Money Transfer Costs

CurrencyFair’s transparent pricing model makes it easy for users to understand the costs associated with international money transfers. This section will provide a detailed look at the exchange rates, transfer fees, and any additional fees that may apply.

Exchange Rates

CurrencyFair provides real-time exchange rates that are highly competitive compared to traditional banks. The platform uses a peer-to-peer model, allowing users to transfer money directly to other CurrencyFair users, bypassing intermediaries and resulting in lower exchange rates.

This makes CurrencyFair even more convenient compared to many money transfer providers. As for the exchange rate markup, CurrencyFair adds a small markup on the current mid-market rate of the selected currency. This markup ranges from 0.10% to 0.60% but it usually falls around 0.45%. It all depends on the amount of money a user is sending and the selected country and currency of the recipient.

Transfer Fees

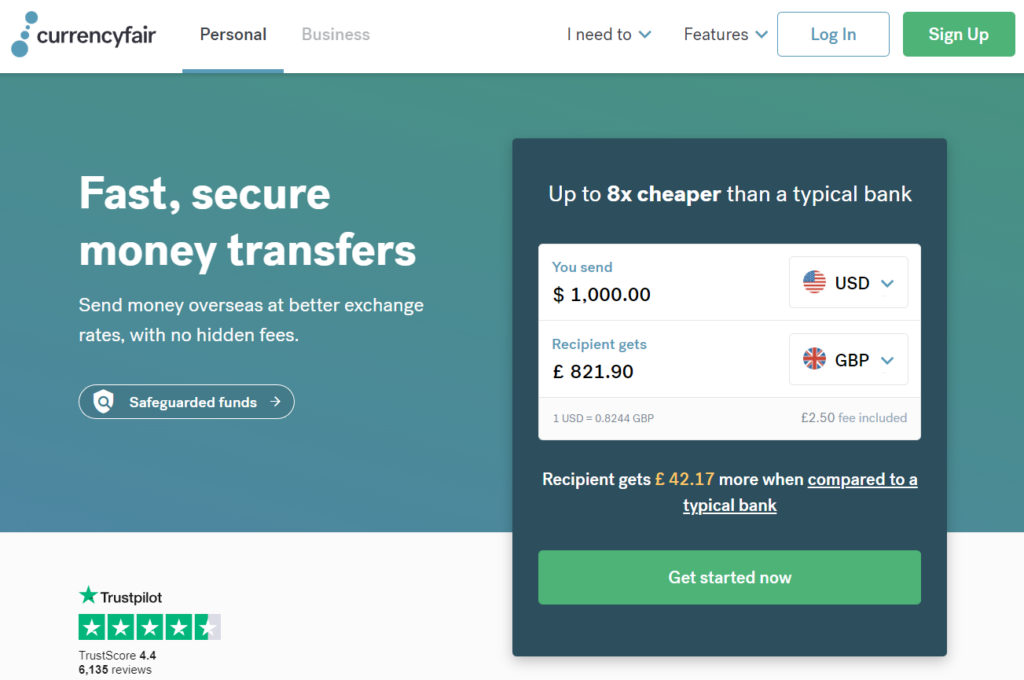

With CurrencyFair, there is no transfer fee for transfers made between CurrencyFair users when exchanging currencies. However, for transfers made to a bank account (when making an international or domestic money transfer), a small fee applies

The CurrencyFair transfer fee is always fixed, no matter the amount of money the user wishes to send. It’s €3.00 (£2.50, or currency equivalent) for the entire transfer. These fees are clearly outlined on the CurrencyFair website.

Additional Fees

There are no hidden fees when using CurrencyFair. Any additional fees, such as bank charges (for example, the SWIFT fee) or local taxes, are clearly communicated to the user before the transfer is made.

Customers can always overview any additional fees that may be charged by third parties even without an online account.

Summary

Considering the above information, we’ve concluded that both personal and business users can benefit from using CurrencyFair’s international money transfer services. Personal users can take advantage of the platform’s peer-to-peer transfer system, competitive exchange rates, and secure mobile app to manage their finances and transfers on the go.

For business users, CurrencyFair offers a range of features designed specifically to meet the needs of businesses, including batch payments, multi-user accounts, invoicing, virtual IBANs, automated FX, and integration with accounting software.

This makes CurrencyFair suitable for making both small and large international money transfers.

How Safe is CurrencyFair?

CurrencyFair takes the safety of its users’ funds and personal information very seriously. The platform implements a range of security measures to ensure that all transfers are secure and user information is protected.

Below, you can overview all the measures and precautions CurrencyFair implements in regard to safety and security:

- Encryption: CurrencyFair uses advanced encryption techniques to protect user information and transactions. This means that sensitive information is securely encrypted before it is transmitted over the internet, making it nearly impossible for hackers to access;

- Multi-Factor Authentication: The platform requires users to verify their identity using multi-factor authentication, adding an extra layer of security to their accounts;

- Segregation of Funds: CurrencyFair keeps customer funds in segregated accounts, which are separate from the company’s operating accounts. This means that in the unlikely event that CurrencyFair were to become insolvent, customer funds would be protected;

- Insurance: CurrencyFair’s insurance policy covers customer funds in the unlikely event of theft or misappropriation by employees;

- Regulatory Compliance: CurrencyFair is regulated by the respective governing bodies in the countries and regions it operates. These compliances adhere to all relevant regulations, including anti-money laundering (AML) and know-your-customer (KYC) laws. This ensures that the platform operates in a transparent and compliant manner. The following are the state regulators that authorize CurrencyFair for operation:

- Central Bank of Ireland in the European Union;

- Financial Conduct Authority (FCA) in the United Kingdom;

- Australian Securities and Investments Commission (ASIC) in Australia;

- Financial Crimes Enforcement Network (FinCEN) in the USA;

- Monetary Authority Singapore (MAS) in Singapore;

- Customs and Excise Department in Hong Kong.

In short, CurrencyFair implements a range of security measures to ensure the safety of its users’ funds and personal information. The platform’s encryption, multi-factor authentication, segregation of funds, regulatory compliance, and insurance policy make it a secure and reliable option for international money transfers.

How Fast is CurrencyFair?

Speed is a key factor when it comes to international money transfers, and CurrencyFair delivers on this front. The platform offers a fast and efficient transfer process, allowing users to send money quickly and securely to other countries.

CurrencyFair’s transfers are typically completed within 0-2 business days, depending on the destination country and currency. This is faster than traditional bank transfers, which can take several business days to complete.

However, in rare cases, transfers can take up to 5 business days to be completed. This can be the case when an exotic country or currency is involved or when the transfer amount is exceptionally high.

In that regard, the speed of all transfers facilitated by CurrencyFair depends on several factors, including:

- Destination country and currency: The speed of a transfer can vary depending on the destination country and the currency being transferred. Some countries and currencies may take longer to process due to local regulations and banking systems;

- Transfer method: CurrencyFair offers several transfer methods, including peer-to-peer transfers and transfers to a virtual IBAN. The speed of the transfer can depend on the transfer method chosen;

- Transfer amount: Large transfers may take longer to process than smaller transfers;

- Compliance checks: CurrencyFair is required to carry out compliance checks to ensure that transfers comply with anti-money laundering and know-your-customer regulations. This can sometimes cause a delay in the transfer process;

- Bank processing times: Transfers may be subject to processing times by the sender and recipient banks, which can affect the overall speed of the transfer.

How to Use CurrencyFair

Using CurrencyFair is a simple and straightforward process that can be done in a few easy steps. Here’s how:

- Sign Up: To start using CurrencyFair, you must first create an account. You can do this by visiting the CurrencyFair website or downloading their app and filling out the required information;

- Verify your identity: CurrencyFair is required to comply with strict regulations as a money service operator. As such, you’ll need to verify your identity by providing government-issued identification and proof of address;

- Add a funding source: To make a transfer, you’ll need to add a funding source. In the case of CurrencyFair, that would be your private or business bank account. CurrencyFair supports multiple currencies, so you can choose the currency you wish to transfer from;

- Initiate a transfer: Once your funding source has been added, you can initiate a transfer by including the amount you want to send, the destination country, and the currency you wish to send. You’ll then be presented with a real-time exchange rate and the transfer fee associated with your transfer;

- Complete the transfer: After the exchange rate has been confirmed, you can complete the transfer by reviewing the details and clicking “send.” The transfer will then be processed and the funds will be delivered to the recipient within 1-5 business days (0-2 business days on average).

With that said, using CurrencyFair to send money abroad is incredibly easy and can be done in minutes, while security is maintained at a high level during every step of the process.

CurrencyFair Money Transfer Cancellation Policy

CurrencyFair’s money transfer cancellation policy is designed to provide users with flexibility and control over their transfers. Here’s a brief overview of the cancellation policy:

- Peer-to-peer transfers: Peer-to-peer transfers can be canceled at any time before the transfer is matched with a counterparty. If the transfer has already been matched, it cannot be canceled;

- Transfers to a virtual IBAN: Transfers to a virtual IBAN can be canceled before the transfer has been processed. Once the transfer has been processed, it cannot be canceled;

- Refunds: If a transfer is canceled, CurrencyFair will issue a refund to the original funding source used to make the transfer. Refunds typically take 3-5 business days to process.

CurrencyFair’s money transfer cancellation policy provides users with the flexibility to cancel transfers if necessary. The policy is designed to ensure that transfers can be canceled in a timely and efficient manner, providing users with peace of mind when making international transfers.

CurrencyFair Customer Service

CurrencyFair provides its customers with a range of support options to help ensure that their transfers are processed smoothly and efficiently. Their customer service options are numerous and include:

- Help Center: CurrencyFair provides a comprehensive Help Center, which is available 24/7. This resource provides answers to a wide range of frequently asked questions, and can be a great starting point for customers seeking assistance;

- Live Chat: CurrencyFair offers live chat support, which is available 24/7. Customers can use this service to receive immediate assistance with any questions or concerns they may have;

- Email Support: Customers can also send an email to CurrencyFair’s support team, which will be answered within 24 hours;

- Phone Support: CurrencyFair provides phone support, which is available during business hours. Customers can use this service to speak with a customer service representative directly.

Additionally, CurrencyFair’s customer support staff is multilingual and their website is available in English, German, and French.

Below are all of CurrencyFair’s contact information for each of their offices:

- Ireland: +353 (0) 1 526 8411 – business hours: 10 pm Sunday – 8 pm Friday GMT;

- Australia: +61 (0) 282 798 642 – business hours: 8 am Monday – 7 am Saturday AEST;

- United Kingdom: +44 (0) 203 3089353 – business hours: 10 pm Sunday – 10 pm Friday GMT;

- Singapore: +65 (0) 3165 0282 – business hours: 5 am Monday – 5 am Saturday SGT;

- Hong Kong: +852 5803 2611 – business hours: 5 am Monday – 5 am Saturday HKT.

How Does CurrencyFair Compare With Its Competitors?

Compared to traditional banks, CurrencyFair offers a more cost-effective solution with lower transfer fees and more competitive exchange rates. Additionally, the platform provides a more convenient and user-friendly experience for users who need to transfer money abroad.

Compared to traditional money transfer companies, CurrencyFair offers fixed transfer fees and an option for peer-to-peer transfers, which are more affordable than ordinary bank transfers. This is a more efficient and streamlined process, allowing users to transfer money quickly and easily without the need for intermediaries.

Below, we’ll compare CurrencyFair with Currencies Direct, XE, and Wise, so you can have a better idea of how this provider differentiates from other major players in the industry. This can also help you realize if they are the best fit for your needs or maybe you need to reconsider your choice.

CurrencyFair vs. Currencies Direct

| Feature | CurrencyFair | Currency Direct |

|---|---|---|

| Founded in | 2009 | 1996 |

| Trading Volume | $300 million each year on average | £9.5 billion in 2021 |

| Trustpilot Rating | 4.4 / 5 | 4.9 / 5 |

| Suitable for | Both small and large money transfers | Large money transfers |

| Transfer Fee | £2.50 (UK) €3 (EU) Currency equivalent for other currencies | No fee |

| Average Exchange Rate Markup | 0.45% on mid-market rates | 0.4% to 1.4% on mid-market rates |

| Minimum Transfer Amount | €8.00 (or currency equivalent) | £1 |

| Maximum Transfer Amount | 10,000,000 (same in every available currency) | £25,000 through the mobile app; £300,000 by placing a special request |

| Transfer Speed | 0-5 working days (0-1 working days on average) | 12-24 hours within Europe; 24-48 hours for overseas transfers |

| Dedicated Dealer | Only for business clients | Yes |

| Countries Covered | Over 150 countries | Over 200 countries |

| Currencies Covered | Over 20 currencies | Over 70 currencies |

| Payment Methods | Only by using a bank account | Bank account, credit/debit card, or check |

| Receiving Methods | Bank account | Bank account |

| Cash Pick-Up Option | No | No |

| Instant Custom Quote | Yes | No. Quotes are available through email for registered users |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Spot contracts, forwards contracts, limit orders, stop-loss orders, recurring transfers, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | No | No. A card for international travelers is available through a third-party service (WeSwap) |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only possible as long as the money transfer hasn’t been matched already. | No |

Read our full Currencies Direct review.

CurrencyFair vs. XE

| Feature | CurrencyFair | XE |

|---|---|---|

| Founded in | 2009 | 1993 |

| Trading Volume | $300 million each year on average | $115 billion in 2018 |

| Trustpilot Rating | 4.4 / 5 | 4.2 / 5 |

| Suitable for | Both small and large money transfers | Both small and large money transfers |

| Transfer Fee | £2.50 (UK); €3 (EU); Currency equivalent for other currencies | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums |

| Average Exchange Rate Markup | 0.45% on mid-market rates | 0.2% to 1.4% on mid-market rates |

| Minimum Transfer Amount | €8.00 (or currency equivalent) | £1 |

| Maximum Transfer Amount | 10,000,000 (same in every available currency) | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand) |

| Transfer Speed | 0-5 working days (0-1 working days on average) | 1-4 working days |

| Dedicated Dealer | Only for business clients | Only for those transferring above $70,000 |

| Countries Covered | Over 150 countries | Over 130 countries |

| Currencies Covered | Over 20 currencies | Nearly 100 currencies |

| Payment Methods | Only by using a bank account | Bank account or credit/debit card |

| Receiving Methods | Bank account | Bank account and cash |

| Cash Pick-Up Option | No | Yes |

| Instant Custom Quote | Yes | Yes |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | No | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only possible as long as the money transfer hasn’t been matched already. | Only for cash pick-up transfers when the cash hasn’t been collected by the recipient |

Read our full XE review.

CurrencyFair vs. Wise

| Feature | CurrencyFair | Wise |

|---|---|---|

| Founded in | 2009 | 2011 |

| Trading Volume | $300 million each year on average | £76.4 billion in 2022 |

| Trustpilot Rating | 4.4 / 5 | 4.5 / 5 |

| Suitable for | Both small and large money transfers | Small money transfers |

| Transfer Fee | £2.50 (UK); €3 (EU); Currency equivalent for other currencies | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average |

| Average Exchange Rate Markup | 0.45% on mid-market rates | No markup on mid-market rates |

| Minimum Transfer Amount | €8.00 (or currency equivalent) | £1 |

| Maximum Transfer Amount | 10,000,000 (same in every available currency) | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. |

| Transfer Speed | 0-5 working days (0-1 working days on average) | 0-2 days (within minutes for over 50% of the transfers) |

| Dedicated Dealer | Only for business clients | No |

| Countries Covered | Over 150 countries | Over 170 countries |

| Currencies Covered | Over 20 currencies | Over 50 currencies |

| Payment Methods | Only by using a bank account | Bank account, credit/debit card, Apple/Google Pay, PayPal |

| Receiving Methods | Bank account | Bank account or ATM (through online account) |

| Cash Pick-Up Option | No | No |

| Instant Custom Quote | Yes | Yes |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Batch payments, invoicing, multi-user access, recurring transfers, digital multi-currency wallet, rate alerts, and API integration |

| Flagship Debit Card | No | Yes |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only possible as long as the money transfer hasn’t been matched already. | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer |

Read our full Wise review.

CurrencyFair Customer Reviews

CurrencyFair has received generally positive customer reviews, with users praising its cost-effective solution for transferring money abroad, user-friendly platform, and fast and secure transfers. The provider’s star rating on Trustpilot is 4.3 out of 5 stars.

Customers appreciate the platform’s competitive exchange rates and lower transfer fees compared to traditional money transfer services. They also value the ease of use of the platform, with many customers finding it quick and simple to initiate transfers.

In terms of security, customers appreciate the measures taken by CurrencyFair to ensure the safety of their transfers, including the use of encryption technology and real-time tracking.

However, like with any financial service, there have also been a few negative reviews, with some customers reporting issues with customer support response times or difficulties with account verification.

Positive CurrencyFair Customer Reviews

CurrencyFair works as advertised. I’ve used CurrencyFair to exchange Euros for USD, then sent USD to the USA. From sending CurrencyFair Euros, exchanging them to USD, then sending them to the USA has taken about 3-4 days. The cost/time of making these transfers has been as advertised and I’m pleased with the money I’m saving as compared to using my German bank for the same services. There have been no transfer issues. Indeed, in my experience, CurrencyFair is easy, relatively quick, and seamless.

– EA

Send money abroad quickly, simply and cheaply. I send money to my family abroad. I arranged a regular transfer from my bank to CurrencyFair and arranged with them to exchange the money and transfer it to the recipients automatically. All I have to do is to ensure that I have enough money in the bank to cover it (and CurrencyFair sends me a reminder.

Initially, I muddled the instructions but was able to speak to a live agent fairly quickly who was friendly and knowledgeable and put me right. I have checked their costs against competitors. Some might be slightly lower for some transactions but not not enough for me to want to change. I have been using CurrencyFair regularly for over ten years.

– George Nowacki

Once you know how CurrencyFair works, it is fairly straightforward. And if you use it frequently then the system is very fast. i.e. money can be transferred on the same day unless the markets are closed. When I have had to call the company they have always been very helpful. Explained things well and solved any problems.

– Jocelyn Millan

Using currency fair is straightforward and fair, and oh so cheap! Though it took me a while to submit the documents needed to have my account approved, the team was so helpful and responsive throughout the process, contacting me and responding to all my emails. I also felt that they took the safety of the transaction seriously and that my money was in safe hands. In the end I received my money at the exact exchange rate, just a small fee taken and no funny business. Would recommend it to anyone. Thanks CurrencyFair!

– Flo

Negative CurrencyFair Customer Reviews

I’ve been using CurrencyFair for about 2 and a half years for my business transactions. Had payment matching issues many times. Actual costs of transactions (exchanged) obviously differ from the advertised numbers, but they remain within the average practice. Their web interface has never worked for exchange setups on a mobile browser. Press the continue button and the interface submits after it has reverted to my chosen rate. Move the slider and the interface is freezing. Vert, very bad mobile experience.

– Sylvain Lewandowski

My first experience was ok, however on second use they suddenly started asking me for more proof of address and I.D. But it was really a stall tactic so they could keep £15 of the original exchange price agreed so instead of receiving £700 I only got £685 (saying it was the exchange rate now, even if it wasn’t when my money was received by them). Don’t think I’ll be using them again!

– Stephanie Milne-Jones

The exchange rates are a bit better than most banks but not as low as you may think. They charge up to 0.6% on the rate plus 3 euro. The calculation of the rate isn’t very transparent or well advertised. The rate depends on the currency you are changing but they refuse to say what the rate is for each currency. I asked. Also the amount that they say that you are saving is totally exaggerated. Better than a bank though.

– Padraic

CurrencyFair works very well from a transactional point of view. Sadly though after years of being a truly open peer-to-peer exchange where one would often achieve a rate which was at or sometimes even better than the spot rate quoted on Bloomberg, they have now introduced a spread to line their own pockets further. So now it’s never better than spot plus 0.5% as far as I can see. So sad – money makes you greedy!

– Red Baron

CurrencyFair Alternatives

It’s important to overview other alternatives to CurrencyFair because different money transfer services offer different benefits and features. By comparing different options, you can make an informed decision about the best platform for your specific needs and requirements. Here, we’re presenting three CurrencyFair alternatives:

Remitly

Remitly is considered a great money transfer service by many users due to its combination of fast transfer speeds, competitive exchange rates, low transfer fees, wide coverage, and user-friendly platform. However, whether Remitly is truly a great money transfer service depends on the specific needs and requirements of the individual user.

For example, some users may prioritize fast transfer speeds and low transfer fees, making Remitly an excellent choice for them. But, for other users, the availability of specific countries or the exchange rate offered may be more important, in which case Remitly may not be the best fit.

Western Union

Western Union is a well-established money transfer service that has been operating for over 150 years. While Western Union and CurrencyFair both offer money transfer services, they differ in several key ways:

- Transfer Speeds: Western Union is known for offering fast transfer speeds, with many transfers being completed within minutes. CurrencyFair, on the other hand, also offers fast transfers but focuses more on offering competitive exchange rates;

- Transfer Options: Western Union offers a wider range of transfer options, including cash transfers, bank transfers, and mobile transfers. CurrencyFair’s platform focuses primarily on online transfers that are facilitated by banking infrastructure;

- Exchange Rates: Western Union’s exchange rates are generally not as competitive as those offered by CurrencyFair. CurrencyFair’s platform uses a peer-to-peer exchange system, which allows it to offer more favorable exchange rates.

TorFX

TorFX is another money transfer service that offers international transfers. In comparison to CurrencyFair, TorFX has some strengths and weaknesses as a potential alternative.

On the upside, TorFX might be better than CurrencyFair when considering exchange rates and their personalized service. TorFX is known for offering highly competitive exchange rates, which can be more favorable than those offered by CurrencyFair in some cases. Additionally, TorFX offers a more personalized service, with dedicated currency brokers who provide support and guidance throughout the transfer process. This can be an advantage for users who value one-on-one support and guidance.

On the other hand, TorFX’s transfer fees can be higher than those offered by CurrencyFair and their transfer speeds can be a bit slower.

Conclusion

Time to wrap up! In this review, we concluded that CurrencyFair is a reliable and user-friendly money transfer service that offers fast transfers, competitive exchange rates, and low transfer fees. The platform’s peer-to-peer exchange system is a great asset for everyone that wants to save on high fees that are regularly incurred by banks and traditional money transfer services.

While CurrencyFair is a great choice for many users, it’s always important to evaluate alternative money transfer services to determine which is the best fit for your specific needs and requirements. With that in mind, we included other services which we compared to CurrencyFair. Additionally, we added a few alternatives that might help those who are still undecided about which provider to go for.

F.A.Q.

Is CurrencyFair suitable for making small or large money transfers?

CurrencyFair is suitable for both small and large money transfers. The platform allows you to transfer any amount of money, starting from a minimum transfer amount of just €8/£7/$10 (or other currency equivalent).

This makes it a great option for both personal and business users who need to make small or large transfers, regardless of the size of the transfer.

Additionally, CurrencyFair’s marketplace and fixed transfer fees make it a very affordable solution for all users, even when they wish to make a large transfer.

The platform’s user-friendly interface and streamlined transfer process make it easy to complete transfers of any size, so you can get the money where it needs to go quickly and efficiently.

How do CurrencyFair determine their currency rates?

CurrencyFair uses real-time market data to ensure that its exchange rates are competitive and up-to-date.

The platform’s exchange rates are updated regularly to reflect changes in the global currency markets, so users can be confident that they are getting the best rate possible when they make a transfer.

When a user initiates a transfer, the platform matches them with another user who is looking to make a transfer in the opposite direction.

This allows CurrencyFair to exchange currency directly between users, bypassing the need for a middleman. This direct exchange results in lower exchange rates, which are passed on to the users in the form of more favorable exchange rates.

Why can’t customers use their debit cards to send money using CurrencyFair?

CurrencyFair does not currently offer the option to send money using a debit card. The platform supports transfers made through bank transfers, which are typically faster and more secure compared to other transfer methods.

Using a bank transfer allows CurrencyFair to offer more favorable exchange rates and lower transfer fees compared to other transfer methods.

Additionally, bank transfers provide a high level of security, ensuring that users’ funds are protected throughout the transfer process.

While not offering the option to send money using a debit card may be a disadvantage for some users, it allows CurrencyFair to focus on providing a cost-effective and secure money transfer service to its users.

If the option to send money using a debit card is important to you, you may want to consider alternative money transfer services that offer this option.