International money transfers have become an increasingly important aspect of our globalized world. With the rise of remote work and cross-border commerce, the possibility to easily and securely send and receive money across borders has become a crucial need for individuals and businesses alike.

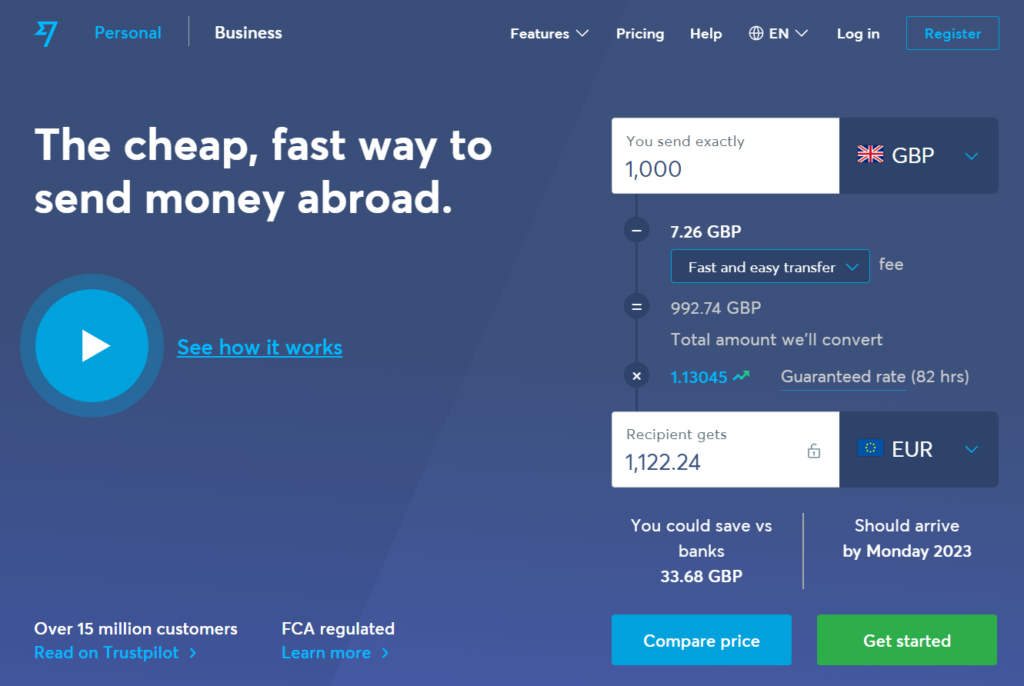

In this context, Wise (formerly TransferWise) has emerged as one of the leading players in the market, offering a fast, low-cost, and transparent solution for international money transfers.

In the lines below, we’ll see what Wise offers for international money transfers and evaluate how well it stands up against the competition. We’ll examine the key features of the service, including its exchange rates, fees, security measures, and ease of use.

Additionally, we’ll explore customer reviews and feedback to provide a comprehensive overview of the user experience. Our goal is to help you determine whether Wise is the right choice for your international money transfer needs, and to understand the extent to which it contributes to the wider international money transfer market.

Who are Wise?

Wise are a FinTech company founded in 2011 with the goal of making international money transfers faster, cheaper, and more transparent. The company has grown rapidly over the years, now serving over 16 million customers in over 70 countries. Wise offers a wide range of services, including international money transfers, borderless accounts, and debit cards, all aimed at making cross-border transactions easier and more accessible.

Wise’s unique peer-to-peer model allows it to bypass the traditional banking system and offer exchange rates that are up to 8 times cheaper than those offered by banks, making it an attractive option for individuals and small businesses looking to transfer money internationally. In addition, the company’s easy-to-use online platform and transparent fee structure have earned it a reputation as one of the leading players in the international money transfer industry.

Wise is well-suited for a wide range of users, including individuals traveling abroad, small businesses with international customers or suppliers, and freelancers and remote workers who need to send or receive payments from multiple countries.

The company’s low fees and competitive exchange rates make it an affordable option for regular money transfers, while their borderless account and debit card allow users to manage their money across multiple currencies with ease.

In summary, Wise is a highly impactful player in the international money transfer market, offering a range of services that make cross-border transactions easy and super accessible.

Wise Pros & Cons

| Pros | Cons | |

|---|---|---|

| 1. | Multiple payment options – Customers can make international money transfers using their debit or credit cards, bank accounts, PayPal, Apple Pay, Google Pay, or other local payment systems that are specific for certain countries. | No cash pick-up options – Recipients can receive their money with Wise only in their personal/business online account or in their bank account. |

| 2. | No exchange rate margins – There are 0% markups on Wise’s exchange rates. Customers can enjoy transferring money in different currencies using the mid-market rates of the current moment. | Issues with customer service – Recent customer reviews on the internet have been largely negative and they mention customer service as the main issue. |

| 3. | High Trustpilot rating – 4.5 / 5 (January, 2023). | No dedicated dealers – Wise doesn’t provide personal account managers for either private or corporate clients. |

| 4. | Global service coverage – Wise facilitates international money transfers in more than 170 countries around the world. | Not suitable for large money transfers – Wise imposes two types of transfer fees which can get pretty high when sending large sums of money compared to other alternatives in the industry. |

| 5. | Extensive knowledge base – Wise’s help section and blog comprise a rich library of helpful information that users can use to get help with all their questions and concerns. | Some high transfer fees – Some transfers involving exotic countries and currencies may incur high transfer fees. |

| 6. | Solid currency coverage – Over 50 currencies are supported when making Wise money transfers. | No coverage for exotic currencies – Customers looking to make transfers in some less-used currencies won’t be able to do so with Wise. |

| 7. | Most suitable for small transfers – Wise is amazing for remittances, making small purchases, paying bills, or transferring low monthly amounts of money to contractors or employees. | |

| 9. | Extensive local coverage – Wise is one of the most spread-out money transfer companies in the world with branches and offices in more than 28 countries. | |

| 10. | Fast money transfers – Half of all Wise money transfers are completed within minutes (those that are usually facilitated through debit/credit cards). The rest take from 0 to 2 working days to complete (on average). | |

| 11. | Instant custom quotes – Wise provides free online custom quotes for reviewing all transfer fees tied to each planned transfer without the need of signing up for an account. | |

| 13. | Exceptional web platform and mobile app – Wise provides one of the best-rated money transfer mobile apps among providers of their type. |

Wise Key Attributes

- Founded: 2011

- Headquarters: London, UK

- Other offices: Wise is available in person in more than 28 locations worldwide, including London (UK), Austin, Dallas, Tampa, and New York (USA), Bangkok (Thailand), Dubai (UAE), Riyadh (Saudi Arabia), Hong Kong (Hong Kong), Shanghai (China), Singapore (Singapore), Tokyo (Japan), Seoul (South Korea), Jakarta (Indonesia), Kuala Lumpur (Malaysia), Manila (the Philippines), Mumbai (India), Brussels (Belgium), Budapest (Hungary), Cherkasy (Ukraine), Tallinn and Tartu (Estonia), Zürich (Switzerland), São Paulo (Brazil), Mexico City (Mexico), Cape Town (South Africa), Sydney and Melbourne (Australia);

- Annual trading volume: Wise handled a staggering £76.4 billion in 2022 in international transactions. Their revenue in 2022 was almost £450 million;

- Number of employees: Wise is a leader in the employment sector in their industry with over 4,500 employees working across offices in 17 different nations on 4 continents;

- Trustpilot rating: 4.5 / 5 in January, 2023 – a solid grade compared to competing international money transfer providers;

- Number of clients: Wise served over 16 million clients in 2022 (a number that constantly increases each year);

- Available countries: With Wise, customers can use money transferring in more than 170 countries all over the world;

- Number of currencies: Currently, Wise offers support for transfers in more than 50 different currencies;

- Minimum transfer limit: Wise doesn’t impose a limit on how small your sending amount can be when making a transfer with them (£1);

- Maximum transfer limit: With Wise, there are limits on how much you can send through them depending on which currency you choose. Major currencies have the following limits:

- $6,000,000 USD;

- $1.8 million AUD;

- $1.5 million CAD;

- €6,000,000 EUR;

- £5,000,000 GBP.

- Transfer fee: Wise imposes two types of transfer fees:

- Variable fee – a percentage of the total amount of the transfer. It can range from 0.35% to 3% depending on the selected currencies and type of payment method (0.4% – 0.6% on average);

- Fixed fee – a small fixed amount no matter how large the transfer amount is. It can range from £0.2 to £2 depending on the selected currencies and type of payment method (£0.2 – £0.3 on average).

- Exchange rate markup: Wise is one of the most convenient international money transfer services when it comes to having additional exchange rate markups. They don’t do this and keep the exchange rates the same as the mid-market rates;

- Sending money through: Wise customers can use a bank account, credit/debit cards, Apple/Google Pay, or other local payment systems to initiate an international money transfer;

- Receiving money through: With Wise, recipients receive their money through their Wise personal or business account. From there, they have the option to withdraw their balance to a bank account or an ATM, or convert them to another currency and send them to other Wise users; The company has no cash pick-up options;

- Supported languages: Wise is available in 15 languages including English, Spanish, French, Portuguese, Italian, German, Chinese, Japanese, Indonesian, Hungarian, Ukrainian, Polish, Romanian, Turkish, and Russian;

- Regulated by: Wise is one of the most regulated money transfer services in the world. Here are some of the top countries and institutions that authorize Wise’s operations:

- National Bank of Belgium in the European Economic Area;

- UK Financial Conduct Authority (FCA) in the UK;

- Financial Crimes Enforcement Network (FinCEN) in the USA;

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in Canada;

- Australian Securities and Investments Commission (ASIC) in Australia.

- Mobile app: Anyone can download Wise’s great mobile app from Google Play for Android (rating of 4.1 / 5 stars) and the App Store for iOS (rating of 4.7 / 5 stars). This extra safe app can be used to:

- Overview exchange rates;

- Set up payment methods;

- Make international money transfers;

- Pay with Google Pay or Apple Pay;

- Repeat previous transfers;

- Hold money in multiple currencies;

- Set up exchange rate alerts;

- Awards: Wise is being constantly awarded for their achievements in the industry, including the following:

- Best European Startup Under 3 Years Old (Europas, 2013);

- One of The World’s Top 10 Most Innovative Companies in Finance (Fast Company Magazine, 2014);

- Boldest Smaller Company (FT’s Boldness in Business Awards, 2014);

- Ernst and Young UK Entrepreneurs (2015);

- Top 20 out of 50 on Glassdoor’s Best Places to Work in the UK (2022);

- Made it in the FinTech50 list in 2013, 2014, 2017, 2018, 2019, and 2021.

Wise Features

Wise offers a range of features to make international money transfers fast, easy, and convenient for its customers. Here are some essential features offered by Wise:

Types of Accounts

Wise allows customers to open two types of accounts: personal accounts and business accounts.

Personal accounts are designed for individuals who want to send money overseas for personal reasons, such as to friends and family, or to pay for goods and services online. Business accounts are designed for small and medium-sized businesses that need to make international payments on a regular basis. There are also options for large corporations that need to pay up to 1,000 employees or contractors situated in many different countries.

Money Transfers

Wise makes it easy for clients to send money to over 170 countries worldwide. Transfers can be made using either a bank account or a debit card, with certain local options like Apple Pay, Google Pay, PayPal, and more.

Wise provides real-time updates on the status of the transfer so customers know exactly when the funds will be available. Customers can choose to make batch payments and recurring payments to initiate the same type of payment multiple times to recipients on their list.

Borderless Account

Wise’s Borderless Account lets clients hold, send, and receive money in multiple currencies, without having to pay conversion fees or hidden charges. This makes it ideal for customers who need to make regular international payments in different currencies.

Wise Debit Card

Wise also offers a debit card, which allows customers to spend their money abroad, free from hidden charges and fees. The debit card can be used anywhere where Mastercard is accepted, and clients can decide to hold their money in a variety of currencies.

Wise for Teams

Wise for Teams is a feature designed for businesses, allowing teams to manage their international money transfers from a single, centralized account. This makes it easier for businesses to keep track of their expenses and manage their cash flow, regardless of where their team members are located.

Wise API

Wise also provides an API for businesses, allowing them to integrate their systems with Wise and automate their international payments. This can help businesses increase efficiency and money, and increase efficiency.

In conclusion, Wise offers a range of features to meet the needs of both individuals and businesses. Whether customers need to make a one-off international money transfer or need to manage regular payments in multiple currencies, Wise has a solution to meet their needs. With real-time updates, and a range of payment options, Wise makes international money transfers fast, easy, and convenient.

Wise International Money Transfer Costs

Wise offers competitive exchange rates and low transfer fees to make international money transfers affordable and accessible to everyone. Here’s a closer look at the costs associated with using Wise.

Exchange Rates

Wise offers competitive exchange rates, which are updated in real-time, so customers can see exactly how much they’ll receive for their money when they make a transfer. Wise uses a mid-market exchange rate, which is the rate banks use when trading with each other, so customers can be confident they’re getting a fair deal. There is no added markup on these rates which is the case with most competitors.

Transfer Fees

Wise charges a small transfer fee for each transaction, which is clearly displayed before the transfer is made. The exact fee depends on the amount being transferred and the country it’s being sent to, but Wise aims to keep its fees as low as possible to make international transfers accessible to everyone.

Wise imposes two types of transfer fees:

- Variable fee – a percentage of the total amount of the transfer. It can range from 0.35% to 3% depending on the selected currencies and type of payment method (0.4% – 0.6% on average);

- Fixed fee – a small fixed amount no matter how large the transfer amount is. It can range from £0.2 to £2 depending on the selected currencies and type of payment method (£0.2 – £0.3 on average).

Additional Fees on International Money Transfers

Wise does not charge any additional fees, such as hidden charges or conversion fees, which means customers can be confident they’ll know exactly how much they’ll pay for their transfer. There are also no fees for receiving money into a Wise account.

Other Fees

Wise’s debit card may be subject to some fees, such as ATM withdrawal fees or foreign transaction fees, depending on the country where the card is used. Wise provides a clear overview of all the fees associated with its debit card, so customers can make informed decisions when using it.

To summarize, Wise’s competitive exchange rates and low transfer fees make this provider a cost-effective solution for small money transfers, which is particularly beneficial for customers who need to send smaller amounts of money regularly or for customers who are just starting to transfer money internationally. With Wise, customers can make small money transfers without having to worry about high fees or unfavorable exchange rates.

How Safe is Wise?

Wise places a high priority on the security of its customers’ funds and personal information. To ensure that transfers are safe and secure, Wise implements a number of security measures and protocols.

Wise uses encryption technology to protect its customers’ sensitive information, such as passwords and personal details. The company also regularly monitors its systems to detect and prevent fraudulent activity.

Wise customers are protected by the FCA’s (Financial Conduct Authority) compensation scheme, which provides up to £85,000 in compensation per person, per firm.

Wise also offers its customers the ability to set up two-factor authentication for their account, providing an extra layer of security for their transfers.

The following are all of the national institutions that regulate Wise:

- National Bank of Belgium in the European Economic Area;

- Financial Conduct Authority (FCA) in the UK;

- Financial Crimes Enforcement Network (FinCEN) in the USA;

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in Canada;

- Australian Securities and Investments Commission (ASIC) in Australia;

- Financial Services Regulatory Authority (FSRA) in UAE;

- Customs and Excise Department (CCE) in Hong Kong;

- Kanto Local Financial Bureau in Japan;

- Central Bank of Brazil in Brazil;

- Reserve Bank of India (RBI) in India;

- Bank Indonesia in Indonesia;

- Bank Negara Malaysia in Malaysia;

- Bangko Sentral Ng Pilipinas (BSP) in the Philippines;

- Monetary Authority of Singapore (MAS) in Singapore.

How Fast is Wise?

One of the key advantages of using Wise for international money transfers is its speed. The time it takes for a transfer to be completed depends on a few factors, like the currencies involved, the payment methods used, and the country of the recipient.

For transfers between bank accounts, Wise typically takes 0-2 business days to complete the transfer. This is because the funds must be processed by both the sending and receiving banks, which can take time. In some cases, the transfer can be done faster or may take longer, depending on the specific banks and countries involved.

For transfers made using a debit card, Wise typically completes the transfer in only a few minutes. However, this may vary depending on the card issuer and other factors.

It’s important to note that the time it takes for the recipient to receive the funds may also vary, depending on the payment method they use and their location. In some cases, the recipient may receive the funds on the same day the transfer is initiated, while in other cases it may take several days, however, almost always faster than making a transfer through a traditional bank.

Wise provides real-time updates on the status of a transfer, so both the sender and the recipient can track the transfer and know exactly when the funds will be available.

How to Use Wise

Making an international money transfer with Wise is easy and straightforward. Here are the steps a customer needs to take:

- Create an account. The first step is to create a Wise account by visiting the Wise website or app and following the prompts to sign up. You will need to include personal information, such as your name, address, and government-issued ID to verify your identity;

- Add a funding source. When your account is created, you will need to add a funding source, such as a bank account or debit card, to send money from. Wise uses this information to withdraw the funds from your account and initiate the transfer;

- Choose the recipient and enter the amount. On the Wise dashboard, you will be able to choose the recipient, enter the amount you want to send, and select the currencies involved in the transfer. Wise will automatically calculate the exchange rate and show you the fees for the transfer;

- Review and confirm. Before the transfer is completed, you will have the opportunity to review all the details and confirm the transaction. Once the transfer is confirmed, Wise will initiate the transfer and keep you updated on its status;

- Receive the funds. The recipient will receive the funds in their bank account or their Wise account if they have one. Wise will notify both the sender and the recipient when the transfer is completed.

It’s important to note that Wise may require additional information or documentation for certain transfers, such as proof of payment for the transaction or proof of identity for the recipient.

When to Use Wise

Wise is suitable for both private clients and businesses looking to send money internationally. However, there are some aspects of the service that are more suitable for each type of client and others that users might find more favorable if they turn to another international money transfer provider.

Private clients

Wise is a great choice for personal transactions, such as paying for overseas purchases, supporting friends or family abroad, paying for college fees or tuition, or sending money to another country for any other reason. The low fees and quick transfer times make it an attractive option for individual use.

Business clients

For business clients, Wise offers a cost-effective solution for making international payments for goods or services. The company’s borderless account feature, which allows businesses to hold and manage money in multiple currencies, is a convenient option for businesses that operate globally or need to make payments in different currencies.

The ability to send and receive international payments with the real mid-market exchange rate, without hidden fees, is another advantage for businesses. They can also take advantage of their invoicing tools and set up recurring, batch payments to send money to employees or contractors abroad.

In conclusion, Wise is best when used by individuals and small businesses for making small money transfers since sending large sums can incur higher transfer fees.

Wise Money Transfer Cancellation Policy

When it comes to canceling a transfer, Wise offers a straightforward policy for its customers. In case a transfer has not been processed, the customer can easily cancel it and the funds will be refunded to the original source. This is usually the case if the transfer is canceled within a few hours of being initiated.

However, if a transfer has already been processed and is in transit, it cannot be canceled. In this case, the recipient of the transfer can choose to refund the transfer back to the sender if they have not yet received the funds. Wise does not charge any fees for cancellations or refunds.

In the event of a canceled or refunded transfer, it is important to note that the time it takes for the funds to be returned may vary depending on the country and payment method used. If you have any questions or concerns about canceling a transfer, you can always reach Wise customer support through their website or app.

Wise Customer Service

Wise is well known for its excellent customer service, which is available 24/7 via email and live chat. The company has a strong reputation for quick and helpful responses to customer inquiries and concerns, with many customers praising the efficiency and friendliness of the customer service team.

Wise also has a comprehensive help center, which includes detailed FAQs and articles on a range of topics related to using the service. In addition, the company enjoys many lively community forums where customers ask questions and receive answers from other users, as well as from Wise staff members.

The company has a strict policy of putting its customers first, and this is reflected in the quality of its customer service. Whether a customer needs help with a money transfer, has a question about their account, or is experiencing a technical issue, Wise’s customer service team is there to provide assistance and support.

As a global company, Wise is available in 15 languages including English, French, Spanish, Portuguese, Italian, German, Chinese, Japanese, Indonesian, Hungarian, Ukrainian, Polish, Romanian, Turkish, and Russian.

How Does Wise Compare With Its Competitors?

Wise is not the only player in the international money transfer space, and it is important to compare it to other providers to determine which one is best suited for your needs. In this section, we will compare Wise with three of its competitors: Xe, TorFx, and Instarem. Take a look to figure out if any of them is more suitable for your particular requirements.

Wise vs. XE

| Feature | Wise | XE |

|---|---|---|

| Founded in | 2011 | 1993 |

| Trading Volume | £76.4 billion in 2022 | $115 billion in 2018 |

| Trustpilot Rating | 4.5 / 5 | 4.2 / 5 |

| Suitable for | Small money transfers | Both small and large money transfers |

| Transfer Fee | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums |

| Average Exchange Rate Markup | No markup on mid-market rates | 0.2% to 1.4% on mid-market rates |

| Minimum Transfer Amount | £1 | £1 |

| Maximum Transfer Amount | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand). |

| Transfer Speed | 0-2 days (within minutes for over 50% of the transfers) | 1-4 working days |

| Dedicated Dealer | No | Only for those transferring above $70,000 |

| Countries Covered | Over 170 countries | Over 130 countries |

| Currencies Covered | Over 50 currencies | Nearly 100 currencies |

| Payment Methods | Bank account, credit/debit card, Apple/Google Pay, PayPal | Bank account or credit/debit card |

| Receiving Methods | Bank account or ATM (through online account) | Bank account and cash |

| Cash Pick-Up Option | No | Yes |

| Instant Custom Quote | Yes | Yes |

| Business Features | Batch payments, invoicing, multi-user access, recurring transfers, digital multi-currency wallet, rate alerts, and API integration | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | Yes | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer | Only for cash pick-up transfers when the cash hasn’t been collected by the recipient |

Read our full XE review.

Wise vs. TorFX

| Feature | Wise | TorFX |

|---|---|---|

| Founded in | 2011 | 2004 |

| Trading Volume | £76.4 billion in 2022 | £7.5 billion annually |

| Trustpilot Rating | 4.5 / 5 | 4.9 / 5 |

| Suitable for | Small money transfers | Both small and large money transfers |

| Transfer Fee | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average | No fee |

| Average Exchange Rate Markup | No markup on mid-market rates | 1% to 2% on mid-market rates |

| Minimum Transfer Amount | £1 | £100 (or currency equivalent) |

| Maximum Transfer Amount | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. | None |

| Transfer Speed | 0-2 days (within minutes for over 50% of the transfers) | 0-2 hours for SEPA transfers; 24-48 hours for ACH transfers |

| Dedicated Dealer | No | Yes |

| Countries Covered | Over 170 countries | Over 100 countries |

| Currencies Covered | Over 50 currencies | 59 currencies |

| Payment Methods | Bank account, credit/debit card, Apple/Google Pay, PayPal | Bank account |

| Receiving Methods | Bank account or ATM (through online account) | Bank account |

| Cash Pick-Up Option | No | No |

| Instant Custom Quote | Yes | No |

| Business Features | Batch payments, invoicing, multi-user access, recurring transfers, digital multi-currency wallet, rate alerts, and API integration | Spot contracts, forwards contracts, limit orders, stop-loss orders, recurring transfers, rate alerts, and API portal |

| Flagship Debit Card | Yes | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer | Possible upon contact unless the recipient received the money (additional fees may apply) |

Read our full TorFX review.

Wise vs. Instarem

| Feature | Wise | Instarem |

|---|---|---|

| Founded in | 2011 | 2014 |

| Trading Volume | £76.4 billion in 2022 | $4 billion annually |

| Trustpilot Rating | 4.5 / 5 | 4.4 / 5 |

| Suitable for | Small money transfers | Both small and large money transfers |

| Transfer Fee | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average | Depends on the selected countries, transfer amount, and payment methods |

| Average Exchange Rate Markup | No markup on mid-market rates | |

| Minimum Transfer Amount | £1 | $50 for IndiaNone for rest |

| Maximum Transfer Amount | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. | Depends on the selected sending country and payment methods |

| Transfer Speed | 0-2 days (within minutes for over 50% of the transfers) | Depending on the bank’s processing time |

| Dedicated Dealer | No | No |

| Countries Covered | Over 170 countries | Over 110 countries |

| Currencies Covered | Over 50 currencies | About 30 currencies |

| Payment Methods | Bank account, credit/debit card, Apple/Google Pay, PayPal | Bank account or credit/debit card |

| Receiving Methods | Bank account or ATM (through online account) | Bank account |

| Cash Pick-Up Option | No | Only for the Philippines |

| Instant Custom Quote | Yes | Yes |

| Business Features | Batch payments, invoicing, multi-user access, recurring transfers, digital multi-currency wallet, rate alerts, and API integration | Batch payments, digital multi-currency wallet, rate alerts |

| Flagship Debit Card | Yes | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer | Possible upon contact unless the recipient received the money (additional fees may apply) |

Read our full Instarem review.

Wise Customer Reviews

Wise has received hundreds of thousands of reviews on Trustpilot, making it the most reviewed company in the foreign currency payments industry with a 4.5/5 rating as of January 2023, down from 4.7/5 at the end of 2020. While researching, we noticed that 91% of all reviews are positive, 7% are negative complaints, and 2% are on the neutral side.

Most positive reviews state that Wise’s main advantage is the smoothness of the entire money transfer experience, but there are concerns about excessive document requirements, delayed transfers, and untimely customer service.

The number of negative reviews is growing, mostly due to deactivated accounts. The firm is facing heat for account holders who cannot access their money despite providing all required information. While some complaints are the lack of superb customer service, some reviews appear to be placed by marketers with the purpose of putting a stain on the service, but their number is rather small.

Positive Wise Customer Reviews

I would highly recommend Wise for both personal and business use. The service is easy to use, offers competitive exchange rates and fees compared to traditional banks, and allows for quick and secure international money transfers. The transparency and clear breakdown of costs are also very helpful. Overall, I have had a positive experience with Wise and would confidently recommend it to anyone looking for a cost-effective way to transfer money internationally.

– Arulkumar Msc

Years of Great experience! I’ve been using Wise since years, when it was called TransferWise. All the way everything worked without complications. The user interface is a delight to use – the transaction speed is very fast. It’s been a great pleasure to use it. The only downside is that transactions to crypto exchanges like Kraken cannot be done. (Maybe the policy changes in the near future). If you don’t have this particular need then it is greatly recommended.

– Lenard Frommelt

I have been so happy with how effortless Wise makes it to transfer and convert my money in many different currencies! This is my first multi-currency account, and I am amazed when I use the card (Apple Pay or physical card) with how it automatically chooses the local currency to spend. I hardly have to lift a finger—I simply ensure there’s enough funds, tap the card, and Wise takes care of all the rest! I would definitely recommend this company, especially for travel!

– Jasmine

Wanted to switch from Payoneer because their account system has massive problems and it took months for support to fix it for me, only for it to cause new issues. Got verified on Wise fast, set up withdrawing from PayPal to Wise within a day (precisely what I was trying to achieve on Payoneer and couldn’t) and managed to send money to a friend without any problems. Conversion rates and fees being good is a nice bonus too. Also, my friend had a referral code that I forgot to put in at account creation but there is a window to put it in shortly after. Very good.

– Androoideka

Negative Wise Customer Reviews

The service quality of Wise is going down day by day. The transfer takes too much time, when I ask wise support why the transfer is taking too long? Wise support has a simple answer; banks take time to process the payment. but when I send the money into the same bank with ACE money transfer, the money arrives within 30 minutes! Thus wise support speaks lies and assumes that I believe in their lie! I am thinking of closing my Wise account because of poor quality and customer service!

– Muhammad Luqman

Hope you don’t need customer support. They’ve held my account up for about a month now. I’m losing money and missing payments because of their slow and inattentive service. Been a customer since their first year and things are only getting worse. Exchange rates are good but they’re not the best and luckily I can easily find a similar and/or better service. Thanks for pushing away yet another customer. Re-evaluate your business schooling.

– Aaron

Wise blocked ALL our transactions due to ‘review’ of one particular transaction?! Why? The whole business simply stopped due to block of all transactions. Support won’t give any details, just ‘wait we review your transaction’ without any potential timeline/deadline etc. The worst support I’ve had ever.

PS. Adding some clarification to the person who is responding here after receiving the response: I’ve contacted support many times and no one was able to provide at least a rough estimate/timeline on the review. There is information within Wise website that the review might take between 2-10 days and in the initial email about the review process we received a 5-10 days deadline, however it’s been almost 3 weeks with no answer. Noone asked for additional details, no one updated us with status etc.

– Andrii Kornytskyi

Wise Alternatives

Wise is not the only option for individuals and businesses seeking to make international money transfers. There are several alternatives to Wise, each with its own unique features and benefits. Here, we’ll discuss three of the most popular alternatives: OFX, MoneyGram, and Revolut.

OFX

OFX (formerly OzForex) is a well-established money transfer company that has been in business for over 20 years. The company offers a range of services, including international money transfers, currency exchange, and foreign currency accounts. For business customers, they offer spot contracts, forward contracts, and market orders as well.

OFX is a solid option for individuals and businesses seeking a more traditional approach to international money transfers, with services that are similar to those offered by traditional banks. However, OFX’s exchange rates and fees may not be as competitive as those offered by other providers, including Wise.

MoneyGram

MoneyGram is a leading money transfer company that operates with more than 350,000 branches in over 200 countries and territories worldwide. The company offers a range of services, including international money transfers, bill payments, money orders, and cash pick-up options.

MoneyGram is a good option for everyone looking for a convenient and accessible solution for sending money to friends and family in other countries. However, MoneyGram’s exchange rates and fees are generally higher than those offered by Wise and other providers.

One of their best assets is their express payment service that’s great for paying bills abroad at lightning speed.

Revolut

Revolut is a digital banking platform that offers a multitude of financial services. Besides international money transfers, they provide currency exchange tools and super-convenient debit cards.

Revolut is amazing as a more comprehensive solution for managing customers’ money across multiple currencies. Their online platform and mobile app are ultra-modern and straightforward and their prepaid debit cards are a popular choice for many who wish to make fast and secure in-store or online transactions.

With that being said, Revolut’s exchange rates and fees are not as transparent as many of their competitors and the company may not be available in all countries.

Conclusion

Throughout this review, we learned that Wise is a leading player in the international money transfer market. With its high level of transparency and strong online trading system and mobile app, Wise has attracted many customers globally.

Wise provides an online account that enables users to make affordable international payments and receive foreign exchange payments into their Wise account. The user experience is considered one of the best in the money transfer space and the debit card that Wise provides for all business users is a high-quality asset for foreign spending purposes.

However, some customers feel that the DIY approach to transferring money abroad may not be suitable for large amounts and prefer the support of a designated account manager with expertise in foreign exchange. Additionally, Wise is facing some challenges as a public company, such as higher fees for some users, slower payments, and account deactivation due to requests for extensive documentation.

F.A.Q.

Who is Wise most suitable for?

Wise is a suitable solution for a range of individuals and businesses who need to send or receive money internationally.

This includes private individuals for small to medium-sized money transfers, small businesses for international payments, freelancers and self-employed individuals for receiving payments from abroad, and expats and travelers for managing finances while abroad.

What information do I need to provide to make a money transfer using Wise?

To make a transfer using Wise, you should ask the recipient for the following information:

– Your full legal name;

– Your bank account number;

– The routing number of your bank account;

– The BIC/SWIFT code of the your bank (depending on the location of the transfer).

Are Wise users able to make money transfers in another name?

No, Wise requires that the recipient’s name match the name on the receiving bank account. This is a security measure to prevent fraud and protect customers’ funds.

Can I transfer money to a mobile wallet with Wise?

No, Wise does not support transfers to mobile wallets at this time. The company currently only supports transfers to bank accounts.

Can I get a free money transfer quote from Wise?

Yes, Wise offers free money transfer quotes. Customers can use the company’s online quote calculator to estimate the cost of a transfer, including exchange rates and fees.

The quote is provided in real time and is based on the latest exchange rates and fees for the specific transfer.

Customers can also use the quote to compare the cost of a transfer with other providers and make an informed decision on the best option for their needs.

Is TransferWise better than Wise?

“Wise” and “TransferWise” are the same company. TransferWise was rebranded as Wise in September 2021.

So, there’s no difference between the two. TransferWise also provided international money transfer services, with a focus on offering transparent, low-cost transfers.

TransferWise was widely recognized as one of the leading international money transfer providers and was also used by millions of individuals and businesses globally.

Does Wise offer discounts and coupons?

Yes, Wise occasionally offers discounts and coupons for its customers. These promotions can include discounts on transfer fees, special exchange rates, or cash bonuses for making a transfer.

The company also has a referral program, where customers can earn cash rewards for referring friends and family to the platform.

Wise may also offer seasonal promotions and discounts, so it is advisable to check the company’s website regularly for the latest offers.

Current Offers:

Special Offer Click here transfer up to 500 GBP with no fees (new customers only)

Also see:

Wise vs Revolut

Wise vs MoneyGram

Wise vs Remitly

Wise vs OFX

Wise vs Currencies Direct

Leave a Reply