XE stands out as a top choice for international money transfers, with a solid track record and competitive rates. But what makes them a good choice for you in particular?

In this article, we’ll take a closer look at the advantages, features, and ease of use of XE Money Transfer, as well as any potential drawbacks. If you’re looking for a reliable and efficient way to send money internationally, read on to see why XE Money Transfer is worth considering.

Who are XE?

XE took off as xe.com in 1993 when they only offered live currency rates services. When they expanded their operations and started offering money transfer services, they were acquired by the Euronet Worldwide Group and merged with the well-known money transfer company HiFX in 2019.

Since then, XE has become a reputable and well-established international money transfer provider that has been in business for over 20 years. With its impressive track record as a specialist in this field, XE transfers over £115 billion worldwide annually for more than 150,000 customers.

XE has built a strong reputation as a solid solution for information on currency exchange rates, trusted by many banks, businesses, and financial institutions. They offer a comprehensive online platform that allows customers to transfer money into more countries and currencies than most other providers, making it an ideal choice for converting money into less-traded currencies.

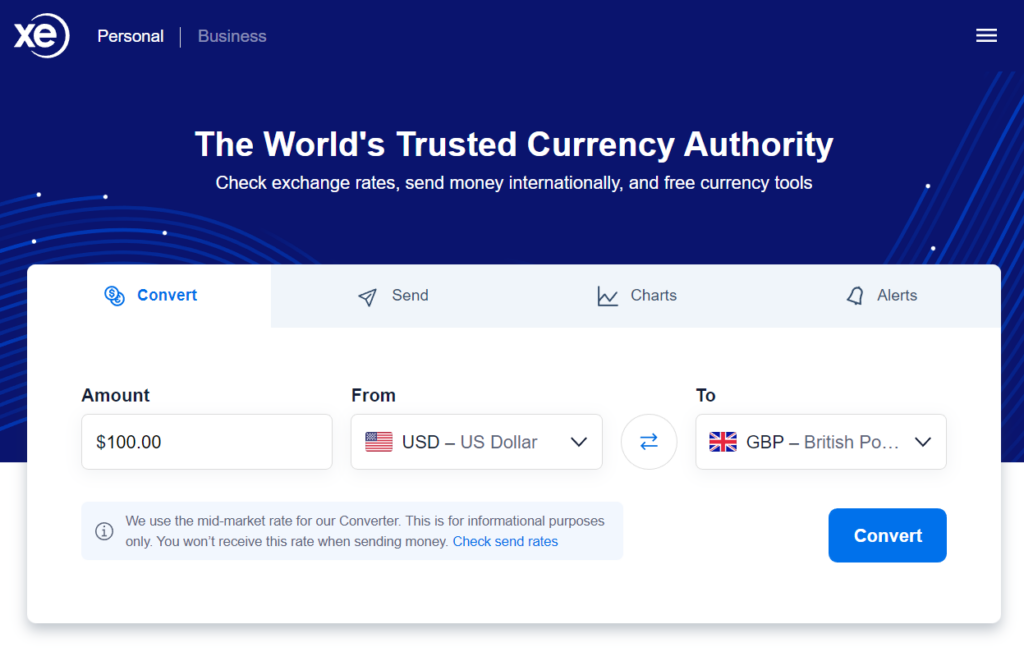

XE offers a variety of services, including customer support over phone and email and an excellent, user-friendly website. They have a great rating on Trustpilot, which is a testament to their popularity and reliability. They also boast a fast and intuitive mobile app, which is available for both Android and Apple devices and offers a range of free tools.

This money transfer platform is also very secure. Its web and app platforms are protected with Norton Security and the company itself is authorized by the FCA. Knowing this, customers can rest assured that they are making a safe choice by entrusting their money to XE.

XE Pros & Cons

| Pros | Cons | |

|---|---|---|

| 1. | Multiple payment options – Customers can use bank transfers, credit/debit cards, or other digital banking methods to send money. | No dedicated account managers for all customers – Clients can acquire dedicated dealers from XE only if they make large money transfers of over $70,000 annually. |

| 2. | Amazing customer service – XE offers multilingual support in over 100 languages for email and chatbot inquiries. | Limited exotic currency coverage – XE doesn’t offer support for transfers in a number of small currencies from countries located in regions including Africa, Asia, Eastern Europe, and South America. |

| 3. | Excellent web platform and mobile app – XE pays great attention to providing easy-to-use, straightforward, fast, and intuitive digital solutions. | Lack of cancellation policy – Once released to the recipient, transfers cannot be terminated. |

| 4. | Option for instant custom quotes – As soon as you access XE’s website or app, you can fill in your transfer details and receive instant information on how much your rates and fees will be. | Average Trustpilot rating – In a couple of years, XE’s Trustpilot rating has fallen from 4.5 to 4.2 stars (out of 5). |

| 5. | Favourable exchange rates – Among the international money transfer providers who impose a markup on their exchange rates, XE is one of the most convenient ones, adding between 0.2% to 1.4% on mid-market rates. | Transfer fees for some small money transfers – Customers in Europe and the UK need to pay €2.00 transfer fee (£2.00 in the UK) for sending an amount under €250 in Europe (£250 in the UK). |

| 6. | Cash pick-up option – Recipients can visit one of the 500,000 XE locations to pick up their money in cash. | |

| 9. | Global service coverage – XE allows for the transfer of funds to a wide range of destinations, including over 170 countries and territories across all continents. | |

| 10. | Solid currency coverage – Customers can send money in over 70 different currencies. | |

| 11. | Local coverage – Customers of XE can receive additional help by visiting one of their physical locations in Canada, the UK, the US, Australia, and New Zealand. | |

| 12. | Extensive experience – XE has been in business for three decades, and after 2019, they’ve “inherited” HiFX’s massive experience in handling international financial operations. | |

| 13. | Fast money transfers – XE completes half of all their money transfers within a few minutes. | |

| 14. | Exchange rate alerts – Customers have the option to receive notifications about exchange rate changes through text messages, mobile app alerts, or email. |

XE Key Attributes

- Founded: 1993

- Headquarters: Newmarket, Ontario, Canada

- Other offices: XE has physical offices in multiple locations in major hubs around the world, mainly in Canada, Australia, the United States, the United Kingdom, and New Zealand;

- Annual trading volume: The latest XE annual report claims that the company has transferred £115 billion in small and large transactions;

- Number of employees: Considering the fact that XE is an international company, we can call them a medium-sized business knowing the number of their employees (it counts about 350 at the moment);

- Trustpilot rating: XE is ranked quite high on the list of best international money transfer companies with a Trustpilot rating of 4.2 out of 5 stars (January, 2023);

- Number of clients: As a company that’s offered many different services over the years, XE has served millions of customers. Today, they handle international and domestic money transfers for about 150,000 clients annually (They boast over 280 million online visitors);

- Available countries: With the exception of about 20 countries, XE is available basically everywhere. That makes them a suitable option for residents of over 170 countries to transfer money safely and reliably;

- Number of currencies: XE’s customers can take advantage of their digital multi-currency wallet where they can keep or send/receive money in over 50 different currencies (depending on their country of residence);

- Minimum transfer limit: XE doesn’t have any limit on how little your transfer can be. The minimum you can send with them is £1;

- Maximum transfer limit: Depending on where you’re registered, XE imposes a limit on the maximum amount of money you can send through them. For residents in the United Kingdom and the European Union that limit is £350,000, US residents can send up to $535,000, Canadians are able to transfer up to CAD $535,000, and those located in New Zealand are allowed to make transfers as large as NZD $750,000;

- Transfer fee: XE does impose transfer fees for customers located in Europe, but only for making small money transfers. The transfer fee for sending an amount under £250 in the UK is £2.00, and for making a transfer of up to €250, the transfer fee is €2.00. Those making transfers larger than these amounts, and everyone located elsewhere won’t incur any transfer fees;

- Exchange rate markup: The markup that XE adds to their exchange rates depends on where you’re located, where your recipient is located, which currencies you wish to use for your transfer, and your chosen payment method. The average markup on their exchange rates ranges from 0.2% to 1.4% on mid-market rates;

- Sending money through: When you need to make a money transfer with XE, you can fund it by connecting your bank account or adding your credit or debit card to your online account. There are also other payment methods available that are also tied to bank transfers, such as direct debit, BillPay, BPAY, PayID, and Interac;

- Receiving money through: Recipients will receive their money in their XE online account. From there, they can choose to withdraw them to their bank account by connecting one, or to schedule a cash-pick up in one of the 500,000 XE locations around the world;

- Payments flexibility: Customers can use XE’s excellent web platform or mobile app to initiate their transfers and pay for them quickly by simply linking their bank account or credit/debit card;

- Supported languages: XE’s website and customer support can be used in English, German, Spanish, French, Portuguese, Italian, Swedish, Arabic, Japanese, and Chinese;

- Regulated by: Currently, XE is authorized by:

- The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Office of the Superintendent of Financial Institutions (OSFI) in Canada;

- Financial Conduct Authority (FCA) in the United Kingdom;

- Financial Crimes Enforcement Network (FinCEN) in the USA;

- Australian Securities and Investments Commission (ASIC) in Australia.

- Mobile app: XE offers a great mobile app that you can get through Google Play for Android (rating of 3.5 / 5 stars) and the App Store for iOS (rating of 4.3 / 5 stars). This app provides many transfer and finance opportunities for customers, including:

- Making international and domestic money transfers;

- Arranging cash pick-up money transfers;

- Tracking each transfer’s status;

- Monitoring currency rates live;

- Holding money in a digital multi-currency wallet;

- Transferring between different currencies;

- Setting up exchange rate alerts.

- Awards: XE cannot boast many official recognitions for their work in the international money transfer space. One award they’ve recently received is the International Money Transfers Outstanding Value Award (Canstar, 2021);

XE Features

XE is a leading provider of international money transfer services, offering a variety of options to its customers. Some of the key features of the service include:

- Bank Transfers: XE allows customers to send money directly to a bank account in over 170 countries. This is a convenient option for those who need to make regular payments, such as for mortgage or rent, or for those who want to transfer money to family members living abroad;

- Online Transfers: In addition to bank transfers, XE also offers the option to send money online. This allows customers to transfer money to a recipient’s e-wallet or mobile money account, which can then be used to make purchases or withdraw cash;

- Cash Pickup: This type of transfer allows customers to send money to a cash pickup location where the recipient can go to collect the money. This is a convenient option for people who live in remote areas or who don’t have access to a bank account;

- Real-Time Tracking: XE’s online platform allows customers to track their transfers in real-time, giving them peace of mind and the ability to see exactly where their money is at any given time;

- Multiple Payment Options: Customers can choose from multiple payment options, including bank transfers, debit cards, and credit cards, to make their transfer easy and convenient;

As for the type of account you can open with XE, the company has a single type of online account that customers can use to access all of their services. However, for businesses that need to make international payments, Xe offers a range of corporate solutions. These solutions include:

- Forward Contracts: This type of transfer allows businesses to lock in an exchange rate for a future date, which can protect them from currency fluctuations. This is particularly useful for businesses that need to make regular payments or for those that are exposed to currency risk;

- Mass and Recurring Payments: This type of transfer allows businesses to make multiple payments at once, which can save time and reduce administrative costs. This is ideal for businesses that need to make multiple payments to vendors or employees in different countries;

- Multi-User Access: This feature allows multiple users within a business to access and make international payments. This can be useful for businesses with multiple locations and departments;

- Dedicated Account Manager: Corporate clients who make large money transfers ($70,000 per year at minimum) get a dedicated account manager that provides a personalized service and support. This can help the business to streamline their international payments and to ensure that the process is smooth.

XE International Money Transfer Costs

Xe is a cost-effective and convenient alternative to traditional banks for international money transfers. The company’s competitive exchange rates and low fees can result in significant savings for customers, and its fast and easy-to-use online platform makes it a convenient choice for those who need to transfer money overseas.

Exchange Rates

Xe typically offers more competitive exchange rates than traditional banks. This is because Xe specializes in currency exchange and has a large volume of transactions, which allows them to offer more favourable rates.

Depending on the amount of money you’re transferring, XE’s exchange fees can range from as low as 0.2% on large money transfers to as high as 1.4% on small money transfers. Factors such as the origin and destination countries and the currencies involved in the transfer are also considered.

Transfer Fees

XE’s transfer service is unique in that it does not charge customers any transfer fees, regardless of the destination country or the currency they choose to convert to. This is different from traditional banks, which often charge fees for international money transfers.

The only exceptions are customers located in Europe when they make small money transfers. The transfer fee for sending an amount under £250 in the UK is £2.00, and for making a transfer of up to €250, the transfer fee is €2.00. Those making transfers larger than these amounts, and everyone located elsewhere won’t incur any transfer fees.

Additional Fees

XE does not have any additional or hidden fees for their services beyond the exchange rate margin. However, customers may be charged third-party fees by the banks that handle parts of the transaction, such as a SWIFT fee. These fees are not charged by XE directly, but rather by the banks they use to provide their services.

Summary

Here are the fees that customers should be aware of when making an international money transfer using XE:

- Transfer fees: 0% (£2.00 under £250 (UK) and €2.00 under €250 (EU));

- Exchange rates: a markup added on the mid-market rate that ranges between 0.2% and 1.4% depending on the amount, the country, and currency of the transfer;

- Third-party fees: SWIFT fees that are charged by the banks handling parts of the transaction.

Some XE customers may face difficulties in determining the rates and fees for a specific transfer due to the absence of a dedicated account manager unless they are transferring a minimum of $70,000 per year.

In conclusion, XE is a great option for making international money transfers of any size. If you’re interested in discovering other money transfer companies, you can check out other providers in our roundup of the best international money transfer services.

How Safe is XE?

XE is one of the international money transfer options out there. They’ve accumulated over 30 years of experience in the financial transfer and currency exchange space while undergoing strict regulations by many state-level agencies.

Today, XE facilitates transfers of £115 billion in worth by serving more than 150,000 private and corporate clients per year.

In 2019, the provider was merged with the reputable international money transfer company HiFX. This company was already well-established on the international market and regulated by official authorization bodies in the countries where they operated.

Xe overtook those operations and the regulations for their financial activities were either transferred from HiFX or acquired with ease. All of that results in the high security protocols that XE implements for all money transfers and currency exchanges that they handle.

XE is regulated in the following major countries:

- The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Office of the Superintendent of Financial Institutions (OSFI) in Canada;

- Financial Conduct Authority (FCA) in the United Kingdom;

- Financial Crimes Enforcement Network (FinCEN) in the USA;

- Australian Securities and Investments Commission (ASIC) in Australia.

Furthermore, XE is a subsidiary of Euronet Worldwide, a publicly traded company that is listed on the NASDAQ stock exchange. This means that it has to report to its shareholders and regulatory bodies and is subject to various financial and operational audits, which is a good indicator of its financial stability.

Additionally, they use bank-level encryption to protect the personal and financial data of their customers when they make online transactions.

As a result of its reputation for reliability and compliance with regulations, XE has experienced significant growth. By 2023, the company managed to expand its money transfer services to over 170 countries and in more than 50 currencies, with a team of over 350 employees.

How Fast is XE?

XE is considered to be a fast provider for international money transfers. The speed of a transfer will depend on several factors, including the amount being transferred, the currencies involved, and the payment method used.

However, XE’s online platform is designed to be user-friendly and efficient, allowing customers to quickly and easily initiate a transfer. Additionally, XE has a large volume of transactions, which allows them to process transfers quickly. Some transfers may be completed within a matter of minutes, while others may take several days to complete.

Typically, the transfer time for bank-to-bank transfers is 1-4 business days. However, some countries and currencies may have longer transfer times in rare cases. XE offers express transfer options that can be completed in as little as 30 minutes, but these services may come at a higher cost.

Regular customers who make small to medium-sized transfers in some of the major currencies (CNH, GBP, AUD, EUR, CHF, JPY, NZD, USD, CAD, or HKD) and between major countries can expect their transfer to be completed within minutes.

If you need an accurate estimate for when your transfer will be completed, you can reach out to XE’s customer service team for assistance. Additionally, you can use the XE mobile app to track the progress of your transfer in real time. You will also receive notifications via email when the transfer is initiated and when it is completed.

How to Use XE

To use XE for international money transfers, you will first need to create an account on the XE website or mobile app. This will require you to provide some personal and financial information, such as your name, address, and bank account information.

Once your account is set up, you can initiate a transfer by selecting the currencies and the amounts you wish to transfer, and the destination for the transfer. You will also need to choose a payment method, such as bank transfer or credit/debit card.

XE will then display your custom quote which will include the exchange rate and any fees associated with the transfer. If you agree to the terms and conditions, you can then proceed with the transfer.

XE will then process the transfer and the funds will be sent to the destination account. You can track the progress of your transfer in real time using the XE mobile app, and you will also receive notifications via email when the transfer is initiated and when it is completed.

If you have any questions or need assistance with your transfer, you can contact XE’s customer service team for help.

XE Money Transfer Cancellation Policy

XE’s transfer cancellation policy may vary depending on the status of the transfer and the payment method used. If a transfer has not been completed, customers may be able to cancel the transfer and receive a refund. However, if the transfer has been completed, customers may not be able to cancel the transfer or receive a refund.

It is recommended to contact XE customer service to inquire about the specific cancellation policy for your transfer. They may have different policies for different types of transfers and for different circumstances. They may also have different policies for small and large amounts, and for different currencies, as well as for different payment methods.

It’s important to know that once the transfer is completed and the money has been sent, it’s not possible to undo the transfer or get refunded because the money is already on its way to the recipient.

XE Customer Service

XE offers customer support through multiple methods, including phone, live chat (usually via their chatbot), and online messaging (online contact form and email). The customer support for money transfers can be reached by phone 24 hours a day, Monday through Friday.

Being physically present in Canada, the US, Australia, the UK, and New Zealand, customers can opt for additional assistance from XE’s office clerks. XE claims to respond to customer support emails within 24 hours and provides responses in over 100 languages (multilingual support is also available when contacting their chatbot tool).

We vouch that XE’s website and app are offered in English, German, Spanish, French, Portuguese, Italian, Swedish, Arabic, Japanese, and Chinese, however, phone support is available only in English.

Based on online reviews, customer service representatives are quite helpful in providing accurate information about transfer time, which usually takes 1-4 days, depending on the destination country.

Below, we include Xe’s phone support numbers concerning money transfers:

- Canada: +1-416-642-6590;

- USA: +1-877-932-6640;

- UK: +44-1753-441844;

- Australia: +61-2-8270-4500;

- New Zealand: +64-9-306-3700;

- Germany: +44-1753-441844;

- Spain: +44-1753-441844.

How Does XE Compare With Its Competitors?

In comparison to its competitors, XE is considered to have a good reputation for providing accurate and up-to-date exchange rates, and its currency conversion tool is widely used by individuals and businesses alike.

However, other competitors like Currencies Direct, Wise, and TorFX offer lower fees for certain transaction types, and some of them also offer additional features such as limit orders, which XE doesn’t offer.

Ultimately, the choice between XE and its competitors will depend on your specific needs and preferences. It’s a good idea to compare fees, exchange rates, and features of multiple providers to determine which one is the best fit for you. Check out the comparison below and get a better picture of XE.

XE vs. Currencies Direct

| Feature | XE | Currencies Direct |

|---|---|---|

| Founded in | 1993 | 1996 |

| Trading Volume | $115 billion in 2018 | £9.5 billion in 2021 |

| Trustpilot Rating | 4.2 / 5 | 4.9 / 5 |

| Suitable for | Both small and large money transfers | Large money transfers |

| Transfer Fee | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums. | No fee |

| Average Exchange Rate Markup | 0.2% to 1.4% on mid-market rates | 0.4% to 1.4% on mid-market rates |

| Minimum Transfer Amount | £1 | £1 |

| Maximum Transfer Amount | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand). | £25,000 through the mobile app; £300,000 by placing a special request. |

| Transfer Speed | 1-4 working days | 12-24 hours within Europe; 24-48 hours for overseas transfers |

| Dedicated Dealer | Only for those transferring above $70,000 | Yes |

| Countries Covered | Over 130 countries | Over 200 countries |

| Currencies Covered | Nearly 100 currencies | Over 70 currencies |

| Payment Methods | Bank account or credit/debit card | Bank account, credit/debit card, or check |

| Receiving Methods | Bank account and cash | Bank account |

| Cash Pick-Up Option | Yes | No |

| Instant Custom Quote | Yes | No. Quotes are available through email for registered users |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Spot contracts, forwards contracts, limit orders, stop-loss orders, recurring transfers, digital multi-currency wallet, rate alerts, and API portal |

| Flagship Debit Card | No | No. A card for international travelers is available through a third-party service (WeSwap) |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only for cash pick-up transfers when the cash hasn’t been collected by the recipient | No |

Read our full Currencies Direct review.

XE vs. Wise

| Feature | XE | Wise |

|---|---|---|

| Founded in | 1993 | 2011 |

| Trading Volume | $115 billion in 2018 | £76.4 billion in 2022 |

| Trustpilot Rating | 4.2 / 5 | 4.5 / 5 |

| Suitable for | Both small and large money transfers | Small money transfers |

| Transfer Fee | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums. | Variable fee – 0.4% – 0.6% of total amount (on average); Fixed fee – £0.2 – £0.3 on average |

| Average Exchange Rate Markup | 0.2% to 1.4% on mid-market rates | No markup on mid-market rates |

| Minimum Transfer Amount | £1 | £1 |

| Maximum Transfer Amount | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand). | $6,000,000 USD; $1.8 million AUD; $1.5 million CAD; €6,000,000 EUR; £5,000,000 GBP. |

| Transfer Speed | 1-4 working days | 0-2 days (within minutes for over 50% of the transfers) |

| Dedicated Dealer | Only for those transferring above $70,000 | No |

| Countries Covered | Over 130 countries | Over 170 countries |

| Currencies Covered | Nearly 100 currencies | Over 50 currencies |

| Payment Methods | Bank account or credit/debit card | Bank account, credit/debit card, Apple/Google Pay, PayPal |

| Receiving Methods | Bank account and cash | Bank account or ATM (through online account) |

| Cash Pick-Up Option | Yes | No |

| Instant Custom Quote | Yes | Yes |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Batch payments, invoicing, multi-user access, recurring transfers, digital multi-currency wallet, rate alerts, and API integration |

| Flagship Debit Card | No | Yes |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only for cash pick-up transfers when the cash hasn’t been collected by the recipient | Users can cancel a transfer as long as they’re able to see the “cancel transfer” option on their transfer |

Read our full Wise review.

XE vs. TorFX

| Feature | XE | TorFX |

|---|---|---|

| Founded in | 1993 | 2004 |

| Trading Volume | $115 billion in 2018 | £7.5 billion annually |

| Trustpilot Rating | 4.2 / 5 | 4.9 / 5 |

| Suitable for | Both small and large money transfers | Both small and large money transfers |

| Transfer Fee | £2.00 under £250 (UK); €2.00 under €250 (EU); No fee for other sums. | No fee |

| Average Exchange Rate Markup | 0.2% to 1.4% on mid-market rates | 1% to 2% on mid-market rates |

| Minimum Transfer Amount | £1 | £100 (or currency equivalent) |

| Maximum Transfer Amount | £350,000 (UK and EU); $535,000 (US); CAD $535,000 (Canada); NZD $750,000 (New Zealand). | None |

| Transfer Speed | 1-4 working days | 0-2 hours for SEPA transfers; 24-48 hours for ACH transfers |

| Dedicated Dealer | Only for those transferring above $70,000 | Yes |

| Countries Covered | Over 130 countries | Over 100 countries |

| Currencies Covered | Nearly 100 currencies | 59 currencies |

| Payment Methods | Bank account or credit/debit card | Bank account |

| Receiving Methods | Bank account and cash | Bank account |

| Cash Pick-Up Option | Yes | No |

| Instant Custom Quote | Yes | No |

| Business Features | Spot contracts, forwards contracts, market orders, digital multi-currency wallet, rate alerts, and API portal | Spot contracts, forwards contracts, limit orders, stop-loss orders, recurring transfers, rate alerts, and API portal |

| Flagship Debit Card | No | No |

| Mobile App | Yes | Yes |

| Cancellation Policy | Only for cash pick-up transfers when the cash hasn’t been collected by the recipient | Possible upon contact unless the recipient received the money (additional fees may apply) |

Read our full TorFX review.

XE Customer Reviews

While XE is a reputable money transfer provider known for its competitive exchange rates, low transfer fees, and fast and reliable money transfer services, they have been receiving a mix of positive and negative reviews online.

About 4% of their online reviews are negative and complaints usually refer to high rates in some cases, non-responsive staff, and issues with their online platform. Despite this, XE has over 50,000 positive reviews, which is quite more than most other companies. The majority of the reviews praise their ease of use, low exchange rates, and wonderful customer service provided by the company.

Some additional mixed reviews mention significant delays with their transfers. Overall, XE has proven to be a strong service and has worked to resolve any issues that its customers may have had.

Below, you can read some actual positive and negative experiences some customers had with XE.

Positive XE Customer Reviews

This is the second time that I am using XE for sending money overseas. First time I was a little bit scared because of some reviews. All went more than well so I am using XE again now. So far no problems at all. I will use them in the future for sure. It is fast, secure and well explained (which was very important for me as I am not a techno geek). Also, conversion rates are very good.

– SASA

Don’t hesitate to use these guys. I’ve been using XE.com to transfer money to the USA for years now. They have never let me down and provide a very reliable service. The transfer is easy to arrange and takes a couple of days and the money is in the bank. I’ve also used it to transfer money to family in Europe and with only a £2.00 transaction fee makes life a lot easier. I would recommend XE.com without reservation.

– Chris

Always a pleasure to use. Good interface. Reliable. With good feedback. Fast. Not sure why it takes 2-3 days to transfer from the UK to Spain, and only minutes from the UK to Colombia. Although the app says it’s done after a few mins, it has a link to a caveat to say it can take 2 days. Not sure if that’s working or calendar days.

– Kevin Kissack

Always a smooth transfer experience with XE.com

XE.com (and HiFX before them) have always made it easy for me to move my money to and from the UK. As this is normally only a couple of times each year, I am always slightly unsure, but the XE.com platform makes it very clear what rates are being locked in, and has always delivered on those. Highly recommended.

– David Morris

Negative XE Customer Reviews

Have used XE for nearly 20 years without any difficulty. This time my payment was delayed, I don’t know why as I received no communication. I had to ring XE to expedite the payment and was told I would receive a call back. No call back was received but the payment was made. As a result of the delay certain payments that I had set up in Spain were not made and now have to be sorted out. I had relied on the usual prompt service from XE which was missing this time.

– Michael

I signed into my online account on my laptop to purchase and transfer 8000 euros. Despite numerous attempts, I could only get one-third of the way to completing the transaction. Called and FINALLY got through to the company by phone and cleared my cache as per instruction from the person I spoke with – all to no avail. The agent also confirmed that my account was in order and that she would notify the tech department about my difficulty. Finally used the mobile app to successfully complete the purchase. The entire process took more than an hour. Have received a helpful response from XE and will follow up once I’m back in Canada.

– Jack

Having been with XE since the days of HiFX, I find that the general level of service has deteriorated since becoming XE. Several times my regular money transfer has been late, I have had several occasions to chase XE for activities surrounding regular money transfers. Contact time is atrocious, waiting sometimes 20 minutes for a human to reply. Often call backs are never made and emails are often very late or no reply. In fact today my regular contact promised to call me regarding the bank rate and to purchase another 6 months money – it never happened. In fact, now for spot purchases I use another company.

– Nigel Dent

XE Alternatives

Below, we list three XE alternatives that are considered great options as they offer low fees, competitive exchange rates, and easy-to-use platforms. Not everyone can benefit from XE’s money transfer services, so the providers below can help by offering features such as budgeting tools, multi-currency accounts, and instant money transfer options.

MoneyGram

MoneyGram is a money transfer service that is known for its wide reach. Present in more than 200 countries and territories, MoneyGram can be used in over 350,000 locations worldwide. It offers a variety of options for sending and receiving money, including online, in-person, and mobile transfers. MoneyGram also offers competitive exchange rates and relatively low fees.

Additionally, MoneyGram provides a number of options for customers to track and manage their money transfers, including SMS notifications, phone and email customer service, and the ability to cancel or modify a transfer.

Another advantage of MoneyGram is that it offers multiple payout options such as cash, bank account deposit, and mobile wallet transfers. It also offers a feature called express payment service which allows you to pay bills or load mobile wallets instantly.

Wise

This is a popular online platform that allows users to send money internationally at a fraction of the cost of traditional banks. It uses a peer-to-peer system that matches people looking to send money in one currency with those looking to receive money in another currency, effectively cutting out the middleman and resulting in lower fees.

Wise also offers a multi-currency debit card, which can be used to spend money abroad without paying any additional fees. Their use of real mid-market rates can help customers get better exchange rates when sending money overseas.

Revolut

Revolut is a digital banking alternative that offers a number of features, including the ability to hold and exchange multiple currencies, as well as make international money transfers. The app also includes a budgeting tool, which helps you to keep track of your spending, and a feature that allows you to set budgets for different categories of spending.

Revolut also includes a feature that allows you to transfer money to other Revolut users instantly and free of charge, regardless of where they are located. The provider is connected with a large network of clients and merchants across the entire world, making their services accessible everywhere and at any time.

Conclusion

Let’s go over what we learned about XE in this extensive XE International Money Transfer Review for 2023.

XE is a well-known and reputable brand in the international money transfer industry, with a wide range of participating countries, currencies, and languages. It boasts a high number of client reviews and a very high satisfaction score, putting it in a good position in the market.

However, it may not be the best option for private clients looking for an online-only service, as other providers like Wise and Currencies Direct may offer better exchange rates and a wider range of services.

Businesses, on the other hand, may appreciate XE’s comprehensive suite of payment options, market intelligence, and the ability to offer credit lines. Overall, XE is a reliable and convenient option for those looking to transfer money internationally.

F.A.Q.

How does XE calculate their exchange rates?

XE calculates its exchange rates by using a combination of bank and market data. The rates are based on the mid-market rate and are updated every 60 seconds.

This means that the exchange rate you see on XE’s website and app is the rate at which banks buy and sell currency to each other. XE also takes into account a small markup to cover its operational costs and generate profit.

Are there any fees for using XE to send money internationally?

XE does not charge any flat fees for its international money transfer service except for some small money transfers for customers located in the EU and the UK.

The rest of the transfers don’t incur any transfer fee, as is the case for all transfers in all other countries.

However, there may be a small markup on the exchange rate to cover costs. This means that the rate you see on XE’s platform is not the exact mid-market rate, but it’s still considered very competitive.

Additionally, depending on the method of payment and the country you are sending money to, there may be additional fees imposed by banks or other intermediaries involved in the transfer process called third-party fees.

How long does it take for my money transfer handled by XE to go through?

The time it takes for a money transfer handled by XE to go through can vary depending on the country and the method of payment you choose. Typically, transfers are completed within 1-2 business days.

However, some destinations or methods may have longer processing times which extend to 4 business days.

For example, if you choose to send money to a bank account, it may take a little longer for the funds to be credited, due to the time required for the bank to process the deposit.

It’s always a good idea to check with XE for the estimated time for your transfer specifically or check the tracking number provided by XE to monitor the status of your transfer.

Can I track my XE money transfer?

Yes, XE provides tracking numbers for each money transfer, which can be used to track the status of the transfer. Once you initiate the transfer, you will be given a unique tracking number that can be used to check the status of your transfer.

You can check the status of your transfer online through the XE website or mobile app, by logging in to your account and checking the “History” section.

It’s also worth noting that XE may send you notifications via email or SMS to keep you updated on the status of your transfer.

What are the available options for receiving money through XE?

XE offers a variety of options for receiving money, including:

Bank account deposit: You can have the funds deposited directly to your bank account in the local currency of the recipient country;

Cash Pickup: You can choose to pick up the funds from one of XE’s partner locations, such as banks or currency exchange bureaus;

Mobile Wallet Transfer: You can transfer the funds to a mobile wallet of your choice, this option is usually limited to certain countries and mobile wallet providers.

Can I cancel or modify an international money transfer that I made using XE?

Yes, you can cancel or modify an international money transfer that you made using XE as long as it has not yet been processed.

If the transfer was already dispatched, the cancellation or modification of the transfer will depend on the destination country, the method of payment, and the status of the transfer.

If the transfer has been processed by XE and it’s on its way to the recipient or was already completed, cancellation is impossible.

Also see:

XE vs Wise

XE vs Revolut

XE vs MoneyGram

XE vs Remitly

XE vs OFX