Exchanging goods, services, and finances is one of the oldest practices of modern civilization. It is also one of the main drivers of its growth, development, and advancement. International trade has shaped the world since ancient times and it’s still responsible for the directions societies take to enhance their position in the global economic market.

Since the 1970s, there’s been a sharp but steady increase in transactions of international nature. Technological advancements, logistics infrastructure, and automation contributed to faster and more reliable transport and storage of over land, sea, and air, which is why the volume throughput of traded goods is ten times higher than what it used to be 5 decades ago.

With the development of our socio-economic systems, the need for regulating international trade exponentially rose. Hence, at the beginning of the 20th century, the Incoterms® rules were established. That marked the start of the development of higher standards of trust between different countries and economic zones.

In this Incoterms 2020 guide, we’ll overview everything that’s covered by this set of rules and all the details that affect the selling and the buying party on both ends of an international sales contract.

The Need for Establishing International Trade Rules

Throughout history, as the development of international trade grew in complexity and scope, so did the necessity of incorporating specialized sectors required to control and maintain all of the different processes and procedures that constitute the trading system.

So, while one department manages stock and orders, another is in charge of the freight transport activities. Then there are the sectors that are responsible for balancing payments, exchange rates, and customs processing. All are working interchangeably so the entire trade “machinery” can function with high efficiency.

The trading trends established in the new global economy model prompted both public administrations and private companies to push for better international commercial regulations that would ensure fair, safe, stable, and controlled flow of goods.

The Foundation of Incoterms®

The need for implementing rules for international trade called for several organizations to be founded that would group all of the companies and public entities dealing with international trade under their umbrella. Among the most prominent international organizations between them are:

- The World Trade Organization (WTO);

- The International Chamber of Commerce (ICC);

- The International Monetary Fund (IMF);

- The International Federation of Customs Brokers Associations (IFCBA);

- The International Federation of Freight Forwarders Associations (FIATA);

- The International Maritime Organization (IMO);

- The Intergovernmental Organization for International Carriage by Rail (OTIF);

- The International Road Transport Union (IRU);

- The International Air Transport Association (IATA).

Most of these organizations are crucial for drafting recommendations and regulations regarding the transactions of international sale and transport of physical goods, particularly in the areas of transshipment logistics and finance.

With so many different countries and other economically-fiscal regions trading among each other, national legislation regarding legal trade almost never extends beyond a country’s domain. That includes different cultures, social and business customs, and languages.

When considering international trade, that’s where difficulties arise. The differences between the selling and the buying party can provoke contract breaches and disrupt the delivery chain.

To eliminate the risks of potential setbacks, in 1936, the International Chamber of Commerce (ICC) came up with the Incoterms® (short of International Commercial Terms) – a set of rules designed to standardize the delivery conditions of goods and provide legal protection for international trade transactions.

What Are the Incoterms® Rules?

The Incoterms® rules clearly and precisely outline each party’s (seller and buyer) rights and obligations in a mutually-signed international sales contract. This contract’s main focus is the terms of delivery of the goods that are the subject of sale.

There are five key aspects that are defined by the Incoterms® rules:

- The responsibilities that are assigned to the seller and the buyer regarding the delivery of the goods in the international sales contract;

- Which party is responsible for the costs of different steps and operations that are part of the logistics chain (packing of goods, hiring of transport, loading and unloading transport vehicles, stowing and unstowing, etc.);

- Which party is responsible for the safety risks and insurance costs of the goods in certain points of the logistics chain and the delivery journey;

- Which party is responsible for performing a custom clearance process of the goods in the cases where this is legally required;

- At what point do the risks of the goods transfer from the seller to the buyer and which are the time and place of the delivery of goods.

Before we point out what’s covered and what isn’t by the Incoterms® rules, we’d like to note that these rules do not constitute the entirety of a sales contract, but put a focus mainly on the aspect of the delivery of the goods.

What’s Regulated by the Incoterms® Rules?

By inspecting the Incoterms® rules, we gathered ten aspects of how they define the obligations of both the selling and the buying party when it comes to the delivery of goods. We’re listing them here:

- Commitments of the selling party:

- Delivering the goods alongside the sales invoice in accordance with the terms listed in the international sales contract;

- Obtaining authorizations, licenses, export clearance, import clearance, security accreditations, and other formal permits regarding the sale of the goods;

- Drafting contracts of insurance and carriage;

- Delivering the goods efficiently until the point of transfer of risks;

- Risks transfer;

- Cost sharing;

- Promptly notifying the buying party about the delivery of the goods;

- Proving and documenting the delivery of the goods;

- Inspection, packing, and labeling of the goods;

- Assisting the buying party with any information requested about the delivery of the goods and any related costs.

- Commitments of the buying party:

- Paying for the goods in accordance with the terms listed in the international sales contract;

- Obtaining authorizations, licenses, export clearance, import clearance, security accreditations, and other formal permits regarding the acquisition of the goods;

- Drafting contracts of insurance and carriage;

- Receiving the goods efficiently from the point of transfer of risks;

- Risks transfer;

- Cost sharing;

- Promptly notifying the selling party about the reception of the goods;

- Proving and documenting the reception of the goods;

- Inspection of the goods;

- Assisting the selling party with any information requested about the reception of the goods and any related costs.

What’s Not Regulated by the Incoterms® Rules?

Earlier, we mentioned that the Incoterms® rules mainly focus on defining the commitments that both the selling and the buying party have in regards to the delivery of the goods. Some aspects, like the commercial part of the sale transaction, are outside the scope of regulations drafted by the Incoterms®.

There are five main aspects in an international sales contract where the Incoterms® rules don’t apply:

- The conditions listed in contract between a carriage carrier and the buying or the selling party;

- The conditions for transfer of ownership of the goods;

- The terms of payment including the price of the goods and the payment methods used in clearing the sales transaction;

- The conditions for regulating a contract breach including the means of resolution;

- Any liability exemptions regarding the condition and delivery of the goods.

The above aspects must be properly defined in the sales contract so that both parties can review them and mutually agree upon the conditions listed.

Another area that is beyond the scope of the Incoterms® rules is the marketing of goods and services. This is important to remember in case of a contract breach.

A key detail that’s also worth remembering is that even though international payment methods aren’t explicitly regulated by the Incoterms® rules, they are often mentioned in contracts and kept in a close relationship. Therefore, this needs to be clearly outlined in the contract as outside payment contract may state otherwise.

Who Are the Incoterms® Rules Important For?

One fact about the Incoterms® rules should be very clear to the selling and the buying party and everyone involved in the worldwide trade of goods – the Incoterms® rules aren’t mandatory. But, they are extremely important and crucial for every operation in the delivery chain to work properly and effectively.

Therefore, it’s a common practice that these rules are widely implemented and incorporated in international sales contracts.

Professional teams and companies of various sizes and importance in the international supply chain should pay careful attention to the Incoterms® rules and consider their guidance when conducting their business. Some of those companies include:

- Air cargo operators;

- Air freight forwarders;

- Commercial port management teams;

- Customs agents;

- Distributors;

- Exporting and importing companies;

- Foreign trade consultants;

- Freight forwarders;

- Financial services;

- Heads of foreign trade in the public administration;

- International logistics operators;

- Insurers;

- Road haulers;

- Railway operators;

- Security advisory companies;

- Shipping agents;

- Shipping companies;

- Security services;

- Transport center management teams;

- Warehousers.

The 2020 Version of the Incoterms® Rules

Since their first draft in 1936, the Incoterms® have been updated and enhanced several times. Their latest, 9th, version was published in September 2019 and went into full effect on January 1st, 2020. This is the Incoterms® version of our guide’s focus.

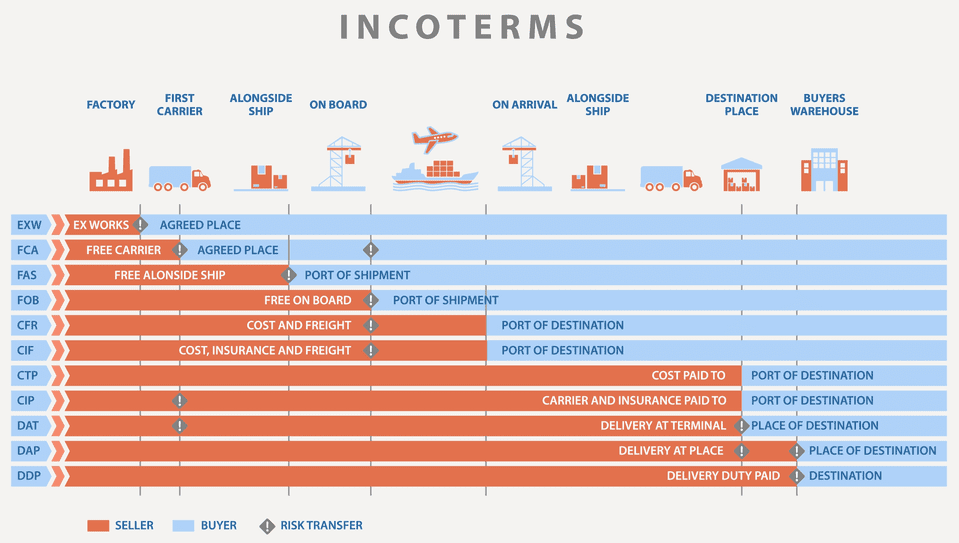

The 2020 Incoterms® contain eleven separate rules that are acronyms of their full terms in English. The following is a list of the 2020 Incoterms® rules including their acronyms and full descriptions:

- EXW – EX Works;

- FCA – Free CArrier;

- FAS – Free Alongside Ship;

- FOB – Free On Board;

- CFR – Cost and FReight;

- CIF – Cost, Insurance, and Freight;

- CPT – Carriage Paid To;

- CIP – Carriage and Insurance Paid to;

- DAP – Delivered At Place;

- DPU – Delivered at Place Unloaded;

- DDP – Delivered Duty Paid.

We can categorize these terms into four groups, as we can notice they all start with one of these four letters: E, F, C, and D. This is convenient for classification of the Incoterms® rules, as each letter group is dedicated to regulating a specific place or transport section of delivery of the goods:

- E rules (Departure):

- Place of delivery of the goods: at origin, in the selling party establishments;

– The selling party delivers the goods within their establishments and makes them available to the buying party there;

- Place of delivery of the goods: at origin, in the selling party establishments;

- F rules (Unpaid Main Carriage):

- Place of delivery of the goods: at origin, when the buying party hires a transport for delivery and pays for it;

– The selling party delivers the goods to a mode of transport without payment;

- Place of delivery of the goods: at origin, when the buying party hires a transport for delivery and pays for it;

- C rules (Paid Main Carriage):

- Place of delivery of the goods: at origin, when the selling party hires a transport for delivery and pays for it;

– The selling party delivers the goods to a mode of transport with payment and immediately transfers the risks;

- Place of delivery of the goods: at origin, when the selling party hires a transport for delivery and pays for it;

- D rules (Arrival):

- Place of delivery of the goods: at a destination designated by the buying party;

– The selling party takes care of transport and delivers the goods at the final destination and bears all the risks.

- Place of delivery of the goods: at a destination designated by the buying party;

There’s another popular categorization of the Incoterms® rules which is based on the mode of transport:

- The Incoterms® rules focusing on transport of any kind are: EXW, FCA, CPT, CIP, DAP, DPU, and DDP;

- The Incoterms® rules focusing on transport that happens at sea or any inland waterway are: FAS, FOB, CFR, and CIF.

Before we perform a deep dive on each Incoterms® rule, we’ll include some important aspects of international trade in our guide. That way, you’ll have a better understanding of what each rule entails. You’ll also be better prepared on how to properly implement them for your particular requirements.

Aspects of International Trade

In this section, we’ll briefly touch upon five major aspects that constitute an international process of delivering goods from a selling party to a buying party. The five points we’ll overview are:

- Modes of Transport;

- Costs and Risks;

- Carriage Contracts;

- Customs Clearance (Export and Import);

- Insurance Policies.

1. Modes of Transport

We mentioned that the Incoterm® rules can be classified depending on which mode of transport is used to deliver the goods from the shipping to the buying party.

The rules that refer to sea transport (including inland waterways) are FAS, FOB, CFR, and CIF. Commonly known as maritime shipping, this type of transport uses all kinds of cargo ships to move goods between sea or river ports. That may include general cargo ships, multi-purpose vessels, feeder ships, oil tankers, reefer ships, container vessels, roll-on/roll-off ships (transporting vehicles), dry bulk carriers, livestock vessels, and more.

The four Incoterms® rules that focus on this mode of transport are suitable for contracting the delivery of goods of a general cargo type (dry bulk, break-bulk, ore, oil, etc.). They are not suitable for containerized cargo. In short, everything that travels only between ports can be handled by these Incoterms® rules.

Containerized cargo that’s shipped using maritime transport and every other type of cargo transport such as air, road, rail, and multimodal transport can be successfully regulated by the other seven Incoterms® rules. Those are EXW, FCA, CPT, CIP, DAP, DPU, and DDP. These rules can apply to any combination of the above-mentioned modes of transport, except when general cargo is transported exclusively port-to-port.

Port-to-port maritime transport that involves breaking down the load units that arrive needs to have a separate contract between the shipper and the carrier.

Multimodal transport that can combine routes that involve ships, trains, trucks, planes, and other means of transport need a different rule of regulation since the load unit isn’t broken down every time a different mode of transport intercepts the shipped cargo.

2. Costs and Risks

International delivery of goods comes with a reasonable amount of costs and risks. There are numerous factors that modify the costs and risks of delivery depending on the distance between the starting point X to the final point Y, the mode (or several modes) of transport necessary for the delivery, the type and nature of the goods (bulk, fragile content, livestock, containerized cargo, palletized cargo, etc.), and other specifications noted in the international sales contract.

We can classify the costs and risks associated with the international delivery of goods based on their initial or final delivery point:

- Costs and risks at origin (starting point) of the goods:

- Verification of the goods;

- Packaging of the goods;

- Configuration of load units;

- Insurance;

- Loading and securing the goods for transport;

- Transport of the goods in the country of origin;

- Export customs clearance;

- Handling the goods when departing the port or terminal in the country of origin;

- Main transport.

- Costs and risks at destination (final point) of the goods:

- Insurance;

- Handling the goods when arriving at the port or terminal of the destination country;

- Import customs clearance;

- Transport of the goods in the destination country;

- Unloading and reception of the goods at the destination point.

The selling party is responsible for all the risks up until the point of delivery of the goods on a specified date and time. A point of delivery can be considered anything that both the selling and the buying parties agree upon in their international sales contract, Hence, the point of delivery can occur at the place of origin (premises of the selling party), at any point while the goods are transported (a distribution platform, while boarding a plane, rail, truck, or ship, a customs terminal, etc.), or at the destination address (premises of the buying party).

There, at the point of delivery, the risks are transferred from the selling party to the buying party on the date and time that was agreed upon.

The cost and risks aspect of the logistics chain process is one of the most vital aspects in the delivery of goods, therefore, the selling and the buying party should both ask himself the following questions so they can successfully draft a comprehensive and effective sales contract:

- What costs and risks are associated with that particular sales transaction?

- Who bears the potential costs and risks associated with the delivery of the goods, to what extent, and on which stage of the delivery route?

3. Carriage Contracts

We mentioned that even though the Incoterms® rules are applying regulatory concerns only to the sales part of a contract, their application strongly influences the terms of hiring transport carriers.

Carriage contracts carry the conditions of an agreement struck by the shipper of the goods and a transport carrier and are an entirely separate document or a separate part of the contract that includes the agreed Incoterms® rules.

Transport companies usually require the party that will bear the costs of shipping the goods to disclose which Incoterms® rules have been drafted in the international sales contract so they can issue a pricing quote based on that information.

4. Customs Clearance (Export and Import)

When it comes to international trade, customs clearance of the goods is always performed at export (sending the goods) and import (receiving the goods).

The procedures of customs clearance involve inspecting the load unit that’s shipped by the selling party and managing the accompanying documentation.

The selling party is also the one that’s in charge of carrying out the export customs clearance procedure under all Incoterms® rules, except in the case of EXW (Ex Works) where the delivery of the goods is carried out within the premises of the ceiling party.

Similarly, the buying party takes responsibility for carrying out the import customs clearance procedures when the goods arrive in the country of destination. This also applies to all Incoterms® rules except the DDP rule (Delivered Duty Paid,) where the conditions underline that all of the delivery costs and risks fall on the selling party.

5. Insurance Policies

Contracting insurance for transporting the goods is mainly optional under the conditions of most Incoterms® rules. The only expectations are CIF (Cost, Insurance, and Freight) and CIP (Carriage Insurance Paid to) where the selling party is required to contract transport insurance and cover against the goods’ risks or damages of the buying party.

Both of these Incoterms® rules refer to the main transport stage of the logistics chain in the delivery of the goods; the only difference being that one of them (CIF) refers only to maritime transport (sea and inland waterways), and the other rule (CIP) applies to all of the modes that are part of the multimodal transport (maritime, rail, road, air, or pipeline).

In any case, both of the pirates can (individually or mutually) agree to contract transport insurance under any Incoterms® rule. This is highly recommended as that could eliminate certain risks that are always present within the transportation chain.

The transport insurance can be contracted under previously agreed conditions drafted in the insurance policies. These conditions can indicate which party insures the goods and covers the risks according to the point of delivery and the transfer of risks.

The Incoterms® 2020 Rules Explained

Here, we’ll elaborate on each individual Incoterms® 2020 rule and explain everything that they entail, which scenarios suit certain Incoterms the best, and which Incoterms are most beneficial to either the selling or the buying party.

First, you can take a look at the following chart where we clearly demonstrate which obligations are required for one of the involved parties and under which Incoterms® rule.

Obligations regarding the delivery of the goods | The Incoterms® 2020 Rules |

|||||||||||

EXW | FCA | FCA | FAS | FOB | CFR | CPT | CIF | CIP | DAP | DPU | DDP |

|

| Packaging | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Export costs for certification, documentation, etc. | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Loading of the goods for inland transport | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Export customs clearance | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Inland transport | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Transport to port or terminal | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Origin port or terminal costs (tax, THC, etc.) | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Free on board | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Main transport | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ | ⬛ |

| Transport insurance | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⚫ | ⬛ | ⬛ | ⚫ | ⚫ | ⚫ |

| Unloading in port or terminal | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ |

| Destination port or terminal costs (tax, THC, etc.) | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ |

| Import customs clearance | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ |

| Transport from port or terminal to destination | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬛ | ⬛ |

| Unloading of goods from final transport | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬜ | ⬛ | ⬜ |

⬛ – the selling company bears the expenses for the obligation under the indicated rule

⬜ – the buying company bears the expenses for the obligation under the indicated rule

⚫ – transport insurance is optional under the indicated rule

- EXW (Ex Works)

- FCA (Free Carrier)

- FAS (Free Alongside Ship)

- FOB (Free on Board)

- CFR (Cost and Freight)

- CIF (Cost, Insurance, and Freight)

- CPT (Carriage Paid to)

- CIP (Carriage and Insurance Paid to)

- DAP (Delivered at Place)

- DPU (Delivered at Place Unloaded)

- DDP (Delivered Duty Paid)

1. EXW (Ex Works)

The first of the Incoterms® rules is unique for several reasons. It’s the only rule in the E-rules group since it’s the only rule that makes the delivery of goods possible at their own point of origin. It’s also the rule that imposes minimal obligations on the selling party but focuses mainly on regulating the obligations of the buying party.

The Ex Works rule enables the selling party to fulfill its obligations without loading the goods on the initial transport that’s taken care of by the buying party. Although, a special option marked as “LOADED”, following the EXW term, can be drafted which entails that the selling company agrees to load the goods onto the initial transport vehicle.

The selling party’s obligations include packaging and labeling the goods and providing the buying party with receipt proof of the sale.

To benefit from the EXW rule, we advise buying parties to ensure loading is included when hiring a transport vehicle in order to avoid unnecessary incidents.

EXW is suitable for shorter distances between the initial and the final destination where the goods are handled in smaller loads or parcel shipments.

Key attributes of EXW:

- Place of delivery: The place of delivery can be the selling party’s own premises or another designated spot that’s assigned in the international sales contract (like a warehouse, distribution platform, factory, depot, etc.);

- Place of transfer of risks: The selling party’s own premises are also the point where the transfer of risks takes place;

- Modes of transport: After receiving the goods, the buying party is responsible for taking care of their transport up to the destination point. The transport for this rule can be multimodal (sea, rail, road, or air);

- Customs clearance: After receiving the necessary documentation from the selling party, the buying party is responsible for carrying out both the export and import customs clearance procedures. If the delivery route passes through multiple countries, transit procedures also fall on the buying party;

- Transport insurance: Since the entire transport of the goods, their risks, and costs, fall on the buying party, it’s up to them to decide whether they would like to insure their load unit against risks/damages while in transport.

Best Practices for EXW (Ex Works)

Our humble opinion on the Ex Works (EXW) Incoterm is that it’s more suitable for domestic trade rather than international trade. Its most common use is for courier pick-ups where the hired courier is responsible for everything from loading to transport and unloading at destination.

As the biggest part of the responsibilities lies on the buying party, we recommend that anyone that agrees on the EXW rule to hire a reliable freight forwarder to carry out everything in the logistics chain and minimize risks and further costs.

2. FCA (Free Carrier)

Free Carrier – FCA is the first of the three F Incoterms® rules and the only rule in this group that refers to multimodal transport.

If the selling and the buying parties agree to settle their international sales contract in accordance with this rule, the selling party takes responsibility for delivering the goods up to the point where the main transport stage of the logistic chain begins.

Unlike many of the Incoterms® rules, the FCA rule provides greater flexibility when deciding what to appoint as the place of delivery. The seller and the buyer parties can choose between the seller’s point of origin (its premises that can include warehouses, distribution platforms, factories, depots, etc.) or a named place where the goods will be made available to commence on their main journey (a sea or inland port, an air cargo terminal, a railway container terminal, a freight forwarder warehouse, etc.)

According to this rule, it’s the buying party’s obligation to hire a carrier for the main transport of the goods and bear its costs and risks.

With this rule, it’s also clear that the selling party is the one who should clear the goods for export and cover the costs for export certification and documentation.

Key attributes of FCA:

- Place of delivery: If the agreed place is the point of origin, the selling party is required to load the goods on board the transport hired by the buying party. If the agreed place of delivery is another named place, the selling party is responsible for loading and delivering the goods via inland transport, making the goods available for unloading by the carrier hired and paid for by the buying party;

- Place of transfer of risks: Depending on the place of delivery, the place of transferring the risks can either be the selling party’s own premises or the named place where the goods are unloaded from the seller’s transport vehicle;

- Modes of transport: The FCA rule makes multimodal transport available for both parties (sea, rail, road, or air) – whether that’s the selling party’s inland transport or the buying party’s main transport;

- Customs clearance: Unlike the EXW rule where all customs clearance procedures were carried out by the buying party, under the FCA rule, it is the selling party obligation to take care of the export customs clearance procedure. Import and transfer clearances are the buying party’s responsibility;

- Transport insurance: The buying party is carrying the biggest part of the liability under this rule, but neither of them is obligated to take out transport insurance.

Best Practices for FCA (Free Carrier)

It should go without saying, but we feel compelled to note that the buying and selling parties need to thoroughly discuss the topic of choosing a precise place of delivery. This is especially important for the buying party as this is the place where the transfer of risks occurs.

Another noteworthy point is that the FCA rule is suitable for transporting goods on containerized cargo for sea transport or truckloads for road transport.

3. FAS (Free Alongside Ship)

The second rule in the F-rules group is the FAS rule – Free Alongside Ship – the first Incoterms® rule designed to regulate international maritime trade transactions.

This rule can be used whenever the buying party hires a vessel to conduct the delivery of the goods during the main transport stage of the logistics chain. Therefore, the FAS rule can only be used for transport that occurs at sea or inland waterways.

The selling party’s responsibilities here extend to providing island transport of the goods up to the dock/quay where the buyer’s hired vessel will be accepting the goods, hence, its name (alongside ship). The seller should deliver the goods on the agreed date and time and supply the buying party with the related maritime/port documents that prove the delivery.

At the buyer’s discretion, the bill of lading, which is a receipt documenting the goods that will be on board to be shipped, can be obtained with the selling party’s assistance.

In short, the selling party’s obligations include packing, labeling, obtaining export clearance, loading, transporting the goods to the corresponding cargo quay or terminal, and unloading.

Key attributes of FAS:

- Place of delivery: The cargo quay or port terminal designated by the buying party, alongside the buyer’s hired vessel, on the date and time specified in the international sales agreement;

- Place of transfer of risks: Same as the place of delivery – as soon as the goods are unloaded from the seller’s transport vehicle and the proper documentation is handed to the buyer’s party representative, it is considered that the risks are transfer to the buying party;

- Modes of transport: The FAS rule is used only when maritime transport is used (general cargo ships, multi-purpose vessels, oil tankers, roll-on/roll-off ships (transporting vehicles), dry bulk carriers, etc.)

- Customs clearance: Under the FAS rule, the selling party bears the obligation to take care of the export customs clearance procedure. The import customs and transfer clearances are the buying party’s responsibility;

- Transport insurance: Like the FCA rule, it’s in the buying party’s interest to acquire transport insurance with the FAS rule, but in practice neither party is restricted to take out transport insurance.

Best Practices for FAS (Free Alongside Ship)

Since the goods are delivered right alongside the buyer’s hired vessel, the FAS rule isn’t best suited when it comes to delivering containerized cargo as shipping containers are only stowed and stored at designated areas.

It is recommended that buyers use the FAS rule if they purchase bulk goods, vehicles, heavy machinery, capital goods, large volumes, and other similarly packed goods.

Careful observation by the buying party is needed when opting for this rule as the “alongside” term can contain several gray areas should a dispute come into question.

4. FOB (Free on Board)

Extending the FAS rule, the FOB Incoterms® rule (Free on Board) is the third and last of the F rules.

It’s another rule that regulates maritime transport (sea and inland waterways) and one more obligation for the selling party than the FAS rule and that’s loading the vessel hired by the buying party with the goods to be delivered.

By doing this, the selling party obtains the bill of lading themselves and is, therefore, required to provide the buying company with it, even though the shipping transport is hired by the latter.

This documentation is obtained at the request of the buying party and the selling party is required to assist them in their request. However, the costs and risks for this obligation are still borne by the buying party.

So, even though the buyer pays for loading and stowing of the goods to their booked ship, the risks at this stage are still carried by the selling party.

The FOB rule is frequently used in bulk shipments and is often accompanied by extensions such as “STOWED” or “STOWED and TRIMMED” which are to denote that the goods have been properly loaded onboard the ship, leveled off, and secured.

Key attributes of FOB:

- Place of delivery: Goods are considered to be delivered by the selling party after they’ve been transported and loaded on the vessel booked by the buying party at the designated guay or port terminal and at the specified date and time;

- Place of transfer of risks: According to the FOB rule in the signed international sales contract, the transfer of risks of the goods passes from the selling to the buying party when the goods are loaded on board the vessel;

- Modes of transport: FOB is only used for maritime transport at sea and inland waterways (general cargo ships, multi-purpose vessels, dry bulk carriers, etc.)

- Customs clearance: Same as with the FAS rule – The selling party is responsible for carrying out the export customs clearance procedure. The import customs and transfer clearances are the buying party’s responsibility;

- Transport insurance: All rules in the F-rules group aren’t mandating the buyer and the seller to insure the goods against risks of damage and loss during their delivery and transport.

Best Practices for FOB (Free on Board)

Buying on the FOB rule is most appropriate when you’re dealing with dry or break-bulk cargo like grains, timber, steel, coil, pipes, heavy equipment, or general cargo packed in boxes, sacks, bales, drums, etc.

Like the FAS rule, containers are loaded onto container vessels by carriers or port facilities so this type of cargo isn’t appropriate for the FOB rule. Of the F rules, the FCA rule is the most suitable one for regulating containerized cargo transport.

5. CFR (Cost and Freight)

The C group of the Incoterms® rules observe the same practice as the E and F rules in regard to the transfer of risks and the delivery of the goods. They all happen in the country of origin.

What’s different is the obligations that the selling party has when it comes to the main transport – according to the C rules, the selling party bears the costs for the main transport of the goods.

The first of these rules – the CFR (Cost and Freight) rule – provides directions within the international sales contract when the main transport of the goods is conducted via maritime means.

The seller’s responsibilities include packing and labeling, loading the goods for inland transport, and unloading them onto a freight vessel that has been booked by this party in advance.

The buying party obligations resume when the goods arrive at the port designated by them. So, they are required to unload the goods from the vessel, pay the necessary port charges, clear them at import customs, transport the goods, and unload them at the final destination.

It is also possible to have the selling party agree to pay for the unloading of the goods at the port of destination. This needs to be explicitly expressed in the sales contract with the CFR extension “LANDED”.

Key attributes of CFR:

- Place of delivery: Even though the selling party bears the costs of the main transport up to the port of destination in the country of destination, the place of delivery of the goods is named the point when the goods are loaded onto the shipping vessel in the country of origin;

- Place of transfer of risks: Same as the place of delivery – as soon as the goods are loaded onto the shipping vessel, the associated risks are considered transferred;

- Modes of transport: The Cost and Freight rule is used only for the movement of goods via maritime transport (general cargo ships, multi-purpose vessels, oil tankers, roll-on/roll-off ships (transporting vehicles), container ships, dry bulk carriers, etc.);

- Customs clearance: Under the CFR rule, the selling party bears the obligation to take care of the export customs clearance procedure. The import customs and transfer clearances are the buying party’s responsibility;

- Transport insurance: A significant part of the risks fall on the buying party under the CFR rule, so, it’s up to them to decide whether they would like to insure their load unit against loss or damage while in transport. As with all previous rules, the CFR rule doesn’t oblige neither the selling nor the buying party to obtain transport insurance.

Best Practices for CFR (Cost and Freight)

The selling party agreeing to bear the costs of the main transport under the CFR rule needs to understand the concepts of “freeloading/unloading times” and “demurrage”.

Freeloading/unloading time is the designated time that a vessel allows for bulk or break-bulk cargo to be loaded or unloaded on or from the vessel. If this timeframe is breached, a charge called demurrage may need to be paid to the party managing the terminal that’s being used or the vessel’s carrier.

On the other hand, the buying party should note that if the cargo has to be transferred to another vessel in special circumstances (such as bad weather conditions), the onward costs are their responsibility.

Finally, while containerized cargo can be bought using the Cost and Freight rule, a more suitable option is to use the CPT (Carriage Paid to) rule.

6. CIF (Cost, Insurance, and Freight)

Practically imposing the same obligations as the CFR rule, the CIF Incoterms® rule (Cost, Insurance, and Freight) has one more requirement for the selling party. That makes it the first rule on this list that requires the selling party to obtain insurance for the transport of the goods during the main stage of the logistics chain.

Just like the CFR rule, this rule is appropriate only for maritime transporting of goods (sea and inland waterways). The other conditions are the same as well – the CIF rule obligates the selling party to take care of the freight costs for the buying party and ensure the goods are transported to the final port of destination.

There, the goods can be unloaded from the shipping vessel if both parties agree on it in their international sales contract by extending the CIF rule with the term “LANDED”.

With this type of regulation, the seller has to make the bill of lading readily available to the buyer as this document is necessary for the latter when intercepting the goods at the destination port.

The bill of lading should also be negotiable, meaning it has to provide the ability for the buyer to sell the goods even before they reach the final port (while still in transit).

Key attributes of CIF:

- Place of delivery: Like with the CFR rule, the goods are assumed to be delivered as soon as they are loaded onto the shipping vessel in the country of origin even though the selling party is the one who bears all of the costs for the main transport and its insurance premium;

- Place of transfer of risks: The risks are also transferred when the goods are assumed to be delivered (loaded onto the shipping vessel);

- Modes of transport: The Cost, Insurance, and Freight rule is used only for the movement of goods via maritime transport (general cargo ships, multi-purpose vessels, oil tankers, roll-on/roll-off ships (transporting vehicles), container ships, dry bulk carriers, etc.);

- Customs clearance: Under the CIF rule, the selling party bears the obligation to take care of the export customs clearance procedure. The import customs and transfer clearances are the buying party’s responsibility;

- Transport insurance: Unlike all previous rules, the CIF rule requires the selling party to opt for a full premium of an insurance policy that insures the cargo while it’s in transit. The policy needs to ensure at least 110% of the full price of the cargo will be paid to the buying party in case of loss or damages. The extra 10% are there with the assumption that that’s the minimum profit that the buyer would make off of the insured cargo.

Best Practices for CIF (Cost, Insurance, and Freight)

The insurance premium paid by the selling party for the good’s transport is usually the basic option offered by insurance companies and oftentimes that might not be enough. Therefore, the buying party is advised to discuss extending the insurance policy with more coverage. Hence, the extra costs for it should be compensated by the buyer.

As with the CFR rule, all kinds of cargo can be transported in accordance with the CIF rule. However, since the transport of the goods is conducted only via sea or inland-waterway vessels, containerized cargo is not recommended to be used with this rule. The CPT rule is a better option in this case as that provides more freedom regarding the modes of transport.

7. CPT (Carriage Paid to)

With the CPT rule (Carriage Paid to), both the selling and the buying party can agree that the place of destination of the goods can be any place on the route from the seller’s premises to the buyer’s premises.

Just like the CIF and CFR rules, according to the CPT rule, the entire transport up to the point of the destination of the goods designated by the buying party is a responsibility of the selling party which bears all the costs connected to this phase. Similarly, the transfer-of-risks stage takes the same approach

But, unlike the CIF and CFR rules which regulate only maritime traffic, all modes of transport can be used when hiring a carriage following the CPT rule (rail, road, air, and sea). Also, unlike the previous C-rules, the CPT rule allows the selling party to deliver the goods to the transporting carrier where they wish (a seaport, a railroad terminal, an air cargo terminal, or road transport on their own premises).

Being in charge of the main transport, the selling party is obligated to provide the buying party with the bill of lading if maritime transport is used or the waybill if other modes of transport are hired.

Key attributes of CPT:

- Place of delivery: With the CPT rule, the goods are assumed to be delivered as soon as the selling party releases them to the carriage company that they booked and paid for;

- Place of transfer of risks: The risks are also transferred when the goods are assumed to be delivered (transferred from the selling party to the employed carrier);

- Modes of transport: The CPT rule makes multimodal transport available for both parties (sea, rail, road, or air) – whether that’s the carrier hired by the selling party that transports the goods to the designated destination point, or the transport hired by the buying party of the goods need to travel further to the buyer’s premises;

- Customs clearance: Since the transfer of risks still occurs within the country of origin, the selling party is responsible for taking care of the export customs clearance procedures. The remaining responsibilities for transit procedures and import customs clearance still fall on the buying party;

- Transport insurance: THE CPT rule is non-binding when it comes to opting for transport insurance of the goods, whether it’s the seller’s or the buyer’s interest to get an insurance policy. The buyer can consider opting for insurance since the transfer of risks with this rule usually happens in the beginning stages of the logistics chain.

Best Practices for CPT (Carriage Paid to)

The CPT rule is more suitable for dealing with containerized cargo than the CFR or CIF rules since they are only appropriate for maritime transport of goods. If the cargo needs to be moved on land, the CPT rule will allow for ground transportations such as rail or road vehicles and air carriages.

Additionally, this rule works well with all kinds of containerized cargo, whether that’s LCL (break-bulk) cargo or FCL (full load) cargo.

8. CIP (Carriage and Insurance Paid to)

The CIP rule (Carriage and Insurance Paid to) is basically an insurance extension of the CPT Incoterms® rule. All of the obligations and responsibilities for the buying and selling parties remain the same as they were under the CPT rule, except that the CIP rule imposes transport insurance to be obtained by the selling party.

Besides the transport of the goods from their own premises to the destination designated by the buying party, under the CIP rule, the selling party is obliged to arrange transport insurance for the entire journey that their transport contract entails.

This last C Incoterms® rule is applicable to all modes of transport and very convenient for the buyer as they have fewer costs for transporting the goods to their desired destination and they get to enjoy protection made possible by an insurance policy covered by the seller.

The rest of the obligations coming with the use of the CIP rule concerning the transfer of risks, place of delivery, and customs clearances are the same as all the rest of the C rules in this group.

Key attributes of CIP:

- Place of delivery: Same as the CPT rule – the goods are considered delivered as soon as they are made available by the selling party to the transport company hired by them;

- Place of transfer of risks: The transfer of risks of the goods takes place at the same time when their delivery is considered completed (as soon as the selling party releases them to the employed carrier);

- Modes of transport: All of the options that constitute the multimodal transport mode are available through the CIP rule (rail, road, sea, and air). For example, the selling party can hire a carrier that will use a truck and a ship to transport the goods to the destination country where the buying party will employ rail carts and vans to deliver the goods to their warehouse;

- Customs clearance: As with all the E, F, and C rules, the CIP rules also requires that the selling party clears all the custom clearance procedures for exporting the goods and makes the documentation available to the buying party so they can cover the costs of the transit procedures (if the goods move through other countries or economic zones) and the import customs when the goods arrive in the country of destination;

- Transport insurance: The London Institute of Insurance in its Institute Cargo Clauses (ICC) notes that any Incoterms® rule that reinforces the acquisition of a transport insurance policy for the sale of goods, needs to require from the selling party to opt for a transport insurance that covers a minimum of 110% of the price paid by the buying party for the sale of goods. Other than the CIF rule, the CIP rule is the second and last of the Incoterms® rules that offers this benefit.

Best Practices for CIP (Carriage and Insurance Paid to)

The CIP rule is frequently used because of the flexibility and benefits that it brings for the buying party. It requires the selling party to insure the transport of the goods to the very point of destination that the buyer designates.

Under the CIP rule, all modes of transport are available to both parties, and because of this reason, transporting containerized goods is encouraged over the other C-rules. The carriage costs are also settled by the seller.

9. DAP (Delivered at Place)

All of the rules in the D Incoterms® are appropriate for the usage of any mode of transport or combination of different kinds of transport (multimodal transport) of the goods subject of sale. They also enforce the highest responsibilities for the selling party in terms of risks and costs for the delivery of goods.

The DAP rule (Delivered at Place) is the first rule in this group that focuses on regulating the delivery of the goods to the point of destination chosen by the buying company. It’s also the first rule that allows the delivery of the goods to take place outside the country of origin.

With the DAP rule, the selling party is also responsible for bearing the risks and costs for transporting the goods through each of the stages of the main transport. In comparison, the rules in the E, F, and C Incoterms® groups allowed for the selling company to deliver the goods and transfer their risks in their country of origin.

The only transport stage that the selling party isn’t required to execute under the DAP rule is the final unloading procedure. This rule allows for the seller to deliver the goods to the final destination point in a perfect state and make them available to the buyer. The latter party can contract the unloading of the goods at the destination port/rail depot/air terminal or do it themselves at their own premises.

Key attributes of DAP:

- Place of delivery: Usually the country of destination, at the designated place of delivery appointed by the buying party. Considering the modes of transport, this can be a major entry port or terminal, or the buying party premises;

- Place of transfer of risks: Same as the place of delivery – the risks are carried by the selling party for the entire duration of the main transport and are transferred to the buying party at the appointed destination, before the goods are unloaded from the hired transport;

- Modes of transport: The DAP rule makes multimodal transport (road, rail, sea, or air) an option for both parties – however, the carrier hired to conduct the main transport from the country of origin to the country of destination is an obligation of the selling party and they cover the costs for this segment;

- Customs clearance: According to this rule, the usual practice where the selling party is responsible for the export customs clearance procedures and the buying party covers the import customs clearance costs when applicable;

- Transport insurance: A significant part of the risks fall on the selling party under the DAP rule, so, it’s up to them to decide whether they would like to insure the goods against damage or loss while they’re in transport. As with most Incoterms® rules, the DAP rule doesn’t enforce neither the selling nor the buying party to obtain transport insurance.

Best Practices for DAP (Delivered at Place)

The D-rules group is very beneficial for buyers as these rules provide security that the rules of the other groups lack. Under the DAP rule, the selling party must ensure that the goods are delivered in a perfect state up to the point of destination.

The DAP rule is suitable mostly for the road transport mode when the goods are delivered via full or groupage truckload where import customs clearance isn’t a requirement.

Traders in economic zones such as the European Union or the Southern African Development Community can benefit from this rule as delivery of goods can be performed without customs clearances.

10. DPU (Delivered at Place Unloaded)

Including an additional benefit for the buying party, the DPU Incoterms® rule (Delivered at Place Unloaded) extends the obligations of the selling party and requires them to unload the goods after they’ve reached their final destination.

Again, the transport carrier is hired by the seller and they bear all the costs and risks associated with the movement of the goods up to the destination of the delivery which is designated by the buyer.

The DUP rule, like the DAP rule, enables all modes of transport and, therefore, allows for the goods to be delivered far beyond the destination port/terminal. The options for delivery of goods can either be a seaport or another terminal in the destination country, a customs services depot, the buyer’s warehouse or storage center, or delivered straight to door.

As soon as the seller’s hired carrier unloads the goods, the buying party can resume with the rest of the procedures in the logistics chain (import clearances, additional transport, storage, etc.)

Key attributes of DPU:

- Place of delivery: It can be anywhere that the buying party agrees to have the goods delivered – either an entry sea port or rail/air terminal in the destination country, at the customs department depot, or at the buyer’s own premises. After the goods are unloaded from the transported that was taken care of by the selling party, they are considered to be delivered;

- Place of transfer of risks: The risks of the delivery of the goods stick with the selling party until they are unloaded from the final carriage of the main transport stage. The transfer of risks happens at the same time as the time of delivery of the goods;

- Modes of transport: The DPU rule allows for all kinds of road, rail, sea, or air transport (multimodal transport) to be used by the parties that engage in an international sales contract;

- Customs clearance: Under the DPU rule, the export customs clearance procedure is taken care of by the selling party and the import customs clearance procedure is still a responsibility of the buying party even though the goods can continue moving beyond that point under the costs of the seller;

- Transport insurance: This rule doesn’t impose restrictions regarding transport insurance as well. The party that would benefit from acquiring a transport insurance for the delivery of the goods would be the seller since they have an obligation to bear the costs and risks for the entire transport of the goods.

Best Practices for DPU (Delivered at Place Unloaded)

Ensuring that the goods are delivered and unloaded in a sound state is a prime responsibility of the selling party according to the DPU Incoterms® rule.

In this regard, The Contracts for the International Sale of Goods convention under the Sale of Goods Act can provide some relief for the selling party in unforeseen cases where the goods are delivered properly.

11. DDP (Delivered Duty Paid)

The last Incoterms® rule is the DDP (Delivered Duty Paid) rule – arguably, the most convenient rule for the buying party.

This rule bears all the characteristics of the other two D rules – obligating the seller to hire a carriage company that will deliver the goods to the destination designated, cover the costs and risks for the duration of the delivery journey, and ensure the goods are properly delivered to the point of destination.

Additionally, the DDP rule also requires the seller party to cover the costs of both the export and the import customs clearance procedures and every transit procedure if necessary.

Another difference that it has from the DPU rule is that the selling party doesn’t have to contract the carrier to unload the goods at the final destination point, which wasn’t the case with the DAP rule.

Goods sold under the DPU rule can be delivered by any mode of transport including containerized cargo that is moved through freight, rail, or road transport.

Key attributes of DDP:

- Place of delivery: As with all the D rules (DAP and DPU), the goods transported under the DPU rule are delivered to a destination appointed by the buying party in the country of destination (either at an entry port or terminal or beyond, to a named place that can be the buyer’s warehouse, a factory, a storage depot, a distribution platform, etc.);

- Place of transfer of risks: The transfer of risks under the DDP rule takes place as with all other Incoterms® – at the place of delivery. As soon as the goods reach the point of destination (and are made available to the buyer) chosen by the buying party during the drafting of the sales contract, the risks are considered to be transferred from the seller to the buyer;

- Modes of transport: The DDP rule allows for multimodal transport (rail, road, sea, or air) to be an available option for the two parties involved in the sales contract. The selling party bears all the costs and risks of the initial, main, and final transport of the goods, unless there’s a requirement by the buying party that they will finalize the transport of the goods after they arrive at the destination port or terminal;

- Customs clearance: Here is where the DDP rule gets to truly shine – the export customs clearance procedure, the import customs clearance procedure and any possible transit procedure are all covered by the selling party;

- Transport insurance: Neither the seller nor the buyer are required to opt for a transport insurance policy. However, the seller is strongly advised to consider acquiring transport insurance since all the risks of delivering the goods fall exclusively under their supervision.

Best Practices for DDP (Delivered Duty Paid)

If the EXW (Ex Works) Incoterms® rule imposed minimum obligations to the selling party and burdened the buying party with most of the risks and costs of the international commercial sale of goods, the DPU rule enforces just the opposite.

The selling party bears the maximum amount of responsibilities that range from packaging and labeling the goods, covering export customs clearances, and transporting the goods to the main carrier, to covering the costs and risks for the main transport, delivering the goods to the final point of destination, and covering the costs for import customs clearance.

Conclusion

Time to wrap up our extensive guide on the Incoterms® 2020 rules in 2022.

This guide explains how important these rules are in facilitating cooperation between selling and buying parties in the international trade sector. They regulate who bears the costs and risks of delivering the goods that are subject to sale in every stage of the logistics chain.

We also saw how these 11 rules are categorized mainly on the mode of transport they allow to be used or where the delivery of goods takes place. According to these criteria, the Incoterms® rules allow either multimodal transport (any type of sea, ground, or air transport) or only sea and inland waterway transport to be used. Also, the place of delivery of the goods divides these rules into four-letter groups – E, F, C, and D groups.

Overall, one crucial thing about the Incoterms® rules should be very clear to everyone involved in the international trade space: The rules help with regulating the obligations of each party involved in the international sales contract. They don’t constitute the entire contract and other agreements should be drafted to cover more responsibilities and liabilities.

F.A.Q.

Am I required to use the latest version of Incoterms® (2020) instead of previous versions such as the Incoterms® 2010?

No. You can state which version of the Incoterms® rules you want to use in your international sales contract by agreeing in writing and stating the year of the version that will be used.

How do the Incoterms® rules facilitate international trade?

A tremendous amount of trade contracts are using the Incoterms® rules to clearly outline which party (seller or buyer) is responsible for the many obligations they have for the duration of the logistics process. It’s worth mentioning that these rules are negotiable so parties can discuss them before agreeing on using them.

What are the advantages and disadvantages of using the Incoterms® 2020 rules in international trade?

The Incoterms® 2020 rules are an amazing asset to international trade for their ability to standardize the complex processes that happen in transport and logistics in international sale agreements. They are easy to understand, globally recognized, and governed and updated by the International Chamber of Commerce (ICC).

Their disadvantages include exposure to more risks and costs for one of the involved parties which may lead to disagreements. Even during the choosing process, the buying and the selling party may come to disagree over which rule to use depending on the benefits it brings them.

What is the formula for implementing an Incoterms® rule in a sales contract and sales receipts?

First, the chosen Incoterms® rule should be noted, followed by the name of the place of the destination, the term “Incoterms®”, and the year of the version which will be used.

For example: DAP Port of Rotterdam Incoterms® 2020.

Judit says

Super worded!

It was useful for me!

Thank you very much! (comment originally written in Hungarian)